2025 AI Bubble Warning in the U.S. Stock Market: What Investors Should Prepare for as Valuations Overheat

AI bubble warnings are rising in the U.S. Learn how valuation risks and market concentration affect your portfolio and what strategies investors need now.

Key Takeaways

✔ Major institutions in the U.S. and Europe are warning that AI stock valuations may be overheating.

✔ AI infrastructure spending is accelerating faster than profit growth, raising correction risks.

✔ Central banks highlight the possibility of a sharp market correction if sentiment turns.

✔ Investors should review AI concentration, ETF overlap, leverage exposure, and scenario planning.

✔ Diversification and a structured risk framework are becoming essential for 2025.

U.S. markets in late 2025 are once again dominated by AI bubble warnings. The Nasdaq and S&P 500 have both experienced multi-day declines, and volatility has increased as investors revisit the sustainability of AI-driven valuations. Several analysts note that the AI narrative may be running ahead of earnings, creating pressure across large-cap tech stocks.

At the same time, central banks and global institutions have begun issuing formal warnings about systemic risks tied to AI-related assets. This shifts the conversation from short-term volatility to a broader question:

How should investors position themselves if the AI boom enters a correction phase?

The sections below examine why AI valuation warnings are intensifying, what market data shows, how central banks view the risks, and what portfolio strategies make sense for 2025 investors.

Why AI Valuation Warnings Are Accelerating: Early Signals from U.S. and European Stock Markets

Market volatility in recent weeks reflects more than routine profit-taking. It signals a re-evaluation of the AI trade that has dominated markets since 2023.

Several factors are driving this shift:

1. Global Sell-Off Triggered by AI Concerns

Major media outlets report that AI enthusiasm pushed valuations to frothy levels, prompting global markets to fall sharply earlier this month. Analysts increasingly argue that AI expectations are expanding faster than the technology’s current economic returns.

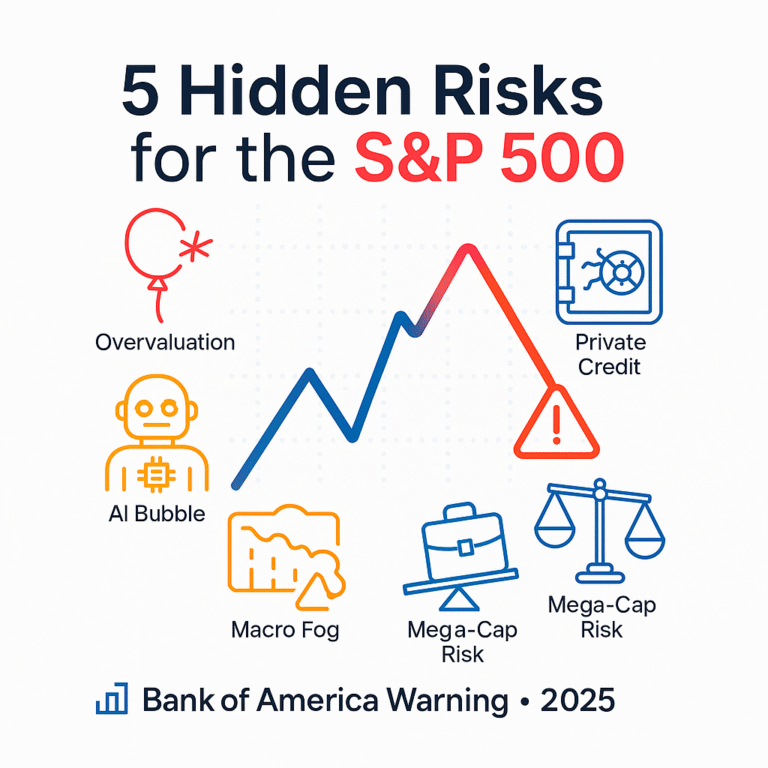

2. Extraordinary Concentration in U.S. Tech Stocks

The Magnificent Seven now represent an outsized share of the S&P 500’s total market cap.

This creates a structural vulnerability:

A single earnings miss can ripple through the entire market chain—indices, ETFs, and sector funds.

3. Central Bank Alerts on AI Asset Prices

The Bank of England and the European Central Bank have both flagged AI-linked assets as a potential financial stability concern. They warn that if sentiment turns, markets could face a “sharp correction”—a phrase central banks rarely use lightly.

Together, these signals point toward a market environment where sentiment, concentration, and valuation are tightly interlinked. Investors are now being encouraged to reassess exposure before volatility accelerates.

What Market Data Shows: The Growing Gap Between AI Expectations, Earnings, and Capex

The core question is how far AI expectations have moved ahead of AI earnings. Recent data highlights three structural gaps:

1. Valuations Rising Faster Than Profits

Many AI-linked companies report solid revenue growth, yet their P/E ratios have expanded at a much faster pace. This indicates investor expectations—not fundamentals—are driving momentum.

2. Surging AI Capex Across Big Tech

Tech companies are pouring billions into data centers, AI chips, cloud expansion, and power infrastructure.

Capex is rising so quickly that analysts worry about a scenario where investment growth outpaces the speed of monetization.

3. Dot-Com Bubble vs 2025 AI Boom: Key Differences and Similarities

|

Category |

Dot-Com Bubble (2000) |

2025 AI Boom |

Interpretation |

|---|---|---|---|

|

Leading companies |

Mostly unprofitable startups |

Cash-rich Big Tech |

Collapse risk lower, but correction risk real |

|

Valuation drivers |

Hype over earnings |

Earnings exist but expectations overextended |

Earnings miss = outsized downside |

|

Investment structure |

VC-driven |

Capex + leverage + corporate investment |

Credit risk must be monitored |

|

Market concentration |

Hidden but high |

Extremely high (Mag 7) |

A single stock can move the index |

|

Long-term outcome |

Many firms disappeared |

AI tech will remain, but winners/losers will diverge |

Stock selection matters more |

The table highlights that the AI boom is not pure hype, but the valuation layer is vulnerable—especially if revenue growth slows or infrastructure ROI lags.

How Central Banks and Investment Banks Frame AI as a Systemic Risk

Central banks aren’t worried because stocks might fall—they’re worried because AI-centric market structure may amplify a downturn.

Three mechanisms explain their concern:

1. Market Concentration as a Shock Multiplier

When a handful of mega-cap AI names drive the S&P 500, any negative earnings surprise can trigger:

- rapid ETF outflows

- sector-wide deleveraging

- algorithmic risk-off flows

This creates cascade effects rarely seen in more diversified environments.

2. AI Infrastructure Spending and Credit Exposure

AI expansion relies heavily on corporate debt, data-center financing, and long-dated investment cycles.

If monetization lags, companies could face repayment pressure—raising systemic credit risks.

3. AI in Trading Models and Risk Systems

Banks increasingly use AI-enhanced models for trading and risk decisions.

If many institutions rely on similar AI models, their reactions to market stress may become synchronized.

This can magnify market swings—a modern version of the “quant meltdown” dynamic.

For these reasons, central banks argue the AI boom must be monitored as a financial stability issue, not merely an equity-market topic.

Portfolio Checklist for Individual Investors: AI Concentration, ETF Overlap, and Leverage Exposure

Investors should objectively assess how much of their portfolio is tied to AI—even indirectly.

1. AI Exposure Ratio

Calculate how much of your total assets are in:

- AI platform companies

- semiconductor leaders

- AI-heavy ETFs

- cloud or data-center plays

A high concentration increases volatility risk.

2. Hidden ETF Overlap

Many ETFs hold nearly identical top-10 positions—often the same Magnificent Seven stocks.

This creates synthetic concentration even when investors believe they are diversified.

3. Leverage and Margin Usage

Leveraged ETFs or margin positions tied to tech magnify losses in a correction.

This is often the biggest driver of forced liquidations.

4. Fundamentals vs Narrative

Investors should compare company fundamentals—revenue growth, margins, cash flow—against current valuations.

A narrative-driven position tends to be fragile during corrections.

5. Scenario-Based Planning

A resilient 2025 portfolio should model two paths:

- Mild correction: 10–20% pullback

- Deep correction: 30–50% decline in tech leaders

Planning ahead prevents emotional trading during volatility spikes.

Three Strategies for Global Investors: Diversification, ETF Diagnostics, and Scenario Frameworks

1. Shift From “AI Only” to “AI + Diversifiers”

The goal is not to reduce AI exposure entirely but to build additional pillars:

- healthcare

- infrastructure

- energy

- consumer staples

- short-duration bonds

- gold or cash equivalents

These assets help stabilize returns when tech corrects.

2. Analyze ETF and Index Structure

Before adding any ETF, review:

- top 10 holdings

- sector weight

- geographic exposure

This prevents holding multiple funds that are effectively the same AI-heavy basket.

3. Build a Scenario-Driven Playbook

This includes:

- rebalancing triggers

- target cash allocation

- hedging rules

- buy-the-dip guidelines for high-conviction names

A structured framework ensures disciplined decisions when markets become emotional.

The 2025 AI bubble warning is not simply a callout of overvaluation. It’s a broader signal that investors should reassess risk concentration, credit cycles, and the sustainability of AI-driven growth.

AI will remain a transformative technology. But its stock-market trajectory may not move linearly—and volatility is likely to increase as expectations adjust.

Now is the time to review:

- how much of your portfolio depends on AI

- whether your ETFs overlap

- how leverage affects your downside

- and how your strategy holds up across correction scenarios

A well-structured plan can help investors capture AI’s long-term upside while staying protected during short-term turbulence.

References

- “Global stock markets fall sharply over AI bubble fears” – The Guardian

- “Why Are Amazon, Microsoft and Other Tech Stocks Down? AI Bubble Fears Cause Market Sell-Off” – Forbes

- “AI Bubble and Growth Fears Are Creeping Into US Credit Markets” – Bloomberg

- “4 signs that investors are rethinking the red-hot AI trade” – Business Insider

- “Is there an AI bubble? Financial institutions sound a warning” – AP News