2025 No-Buy Movement Economic Impact: How U.S. Consumer Slowdown Trend Shapes Investor Sentiment

The 2025 No-Buy movement is reshaping U.S. consumer slowdown trends. Explore its economic impact, shifting financial sentiment, and what it means for investors.

Key Takeaways

✔ The 2025 No-Buy movement is driving a U.S. consumer slowdown trend.

✔ Consumer confidence decline shows the link between consumer spending and investor sentiment.

✔ Investors may need to adjust toward defensive and value-focused strategies.

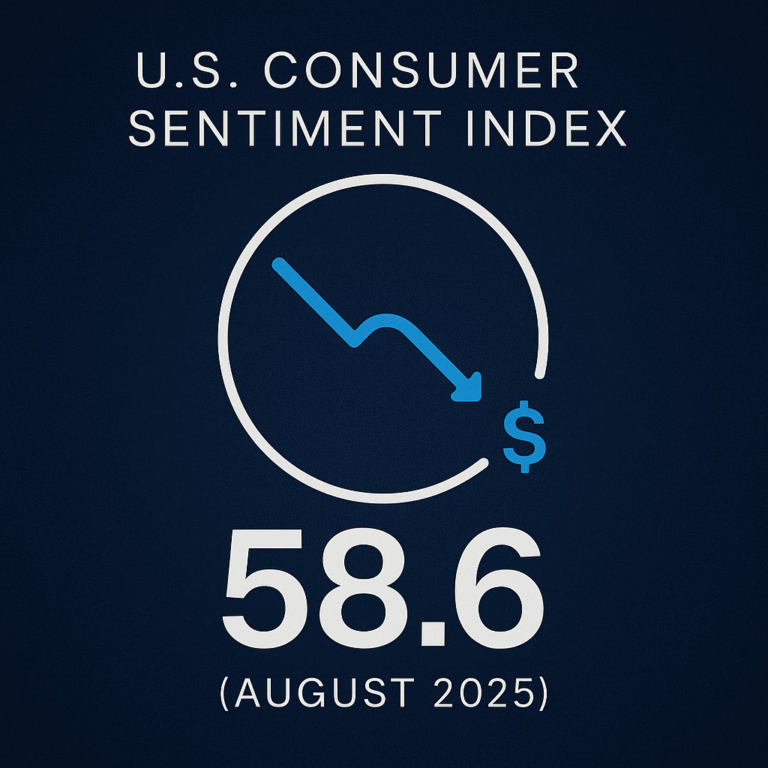

In September 2025, U.S. consumer confidence dropped sharply. The Conference Board’s index slipped to 94.2, while the University of Michigan’s sentiment index fell to 55.1. Both indicators confirm a clear U.S. consumer slowdown trend.

But numbers alone don’t tell the full story. A cultural shift, known as the 2025 No-Buy movement, is pushing households to cut discretionary spending. This shift reflects both economic stress and value-driven lifestyle choices. Understanding the economic impact of the No-Buy movement is critical for investors who need to see the link between consumer spending and investor sentiment.

Why the No-Buy Movement Started and Why It’s Growing

The 2025 No-Buy movement encourages consumers to halt all non-essential purchases. Originally tied to minimalism and financial discipline, it has grown due to inflation, high interest rates, and rising debt burdens.

Search data highlights this growth. Google searches for “no buy challenge” rose 40% year over year. On TikTok and Instagram, the hashtag #NoBuy2025 has gone viral. This shows how the 2025 No-Buy movement economic impact is extending beyond personal finance into cultural and social trends.

Key Indicators Showing the U.S. Consumer Slowdown Trend

Official data underscores the trend. The Michigan Sentiment Index dropped from 58.2 in August to 55.1 in September. The Conference Board index fell to 94.2, with big-ticket purchase plans weakening.

These declines reflect the U.S. consumer slowdown trend and highlight the link between consumer spending and investor sentiment. When households hesitate to spend, markets and policymakers take notice.

Comparing No-Buy Trends and Consumer Sentiment Data

|

Indicator |

2024 Baseline |

Latest (2025) |

Key Drivers |

|---|---|---|---|

|

Michigan Sentiment Index |

~70.1 |

55.1 (Sept 2025) |

Inflation, high rates, uncertainty |

|

Conference Board Confidence |

Low 100s |

94.2 (Sept 2025) |

Job concerns, weaker big-ticket demand |

|

Google Searches (No Buy) |

Baseline |

+40% YoY |

Social and cultural adoption |

This comparison shows that the 2025 No-Buy movement economic impact aligns with the downturn in traditional sentiment data. Both indicators confirm weaker consumer confidence.

Expert Insights on the Link Between Consumer Spending and Investor Sentiment

- Investopedia notes: “With nearly 70% of U.S. GDP tied to consumption, the No-Buy trend could have wide economic impact, reducing corporate earnings, jobs, and tax revenue.”

- McKinsey reports: “Consumer behavior is shifting permanently. People are cutting impulse buys while prioritizing value-driven categories.”

- Forbes adds that luxury brands are seeing slower growth because younger consumers avoid unnecessary spending.

These insights reinforce the link between consumer spending and investor sentiment. When spending slows, investor confidence follows.

How Consumer Slowdown Affects Markets and Investor Strategies

The U.S. consumer slowdown trend creates direct risks for investors.

- Consumer and retail stocks may underperform as discretionary demand fades.

- Small retailers face higher risks due to thinner margins and fixed costs.

- Tax revenue may weaken, straining budgets.

- Negative feedback loops could develop: lower spending → weaker earnings → job fears → even lower sentiment.

To mitigate the economic impact of the No-Buy movement, investors may need to rebalance toward defensive sectors such as staples, utilities, and healthcare.

What’s Next for the No-Buy Movement and Consumer Sentiment

The future of this slowdown depends on several factors.

- If inflation eases and rate cuts occur, household spending could recover.

- Policymakers may introduce tax relief or vouchers to stimulate consumption.

- The 2025 No-Buy movement could also evolve into a long-term cultural shift, embedding frugality into U.S. consumer behavior.

The 2025 No-Buy movement economic impact extends well beyond a temporary trend. It signals a deeper cultural and financial realignment. The U.S. consumer slowdown trend is a reminder of how closely the link between consumer spending and investor sentiment shapes markets.