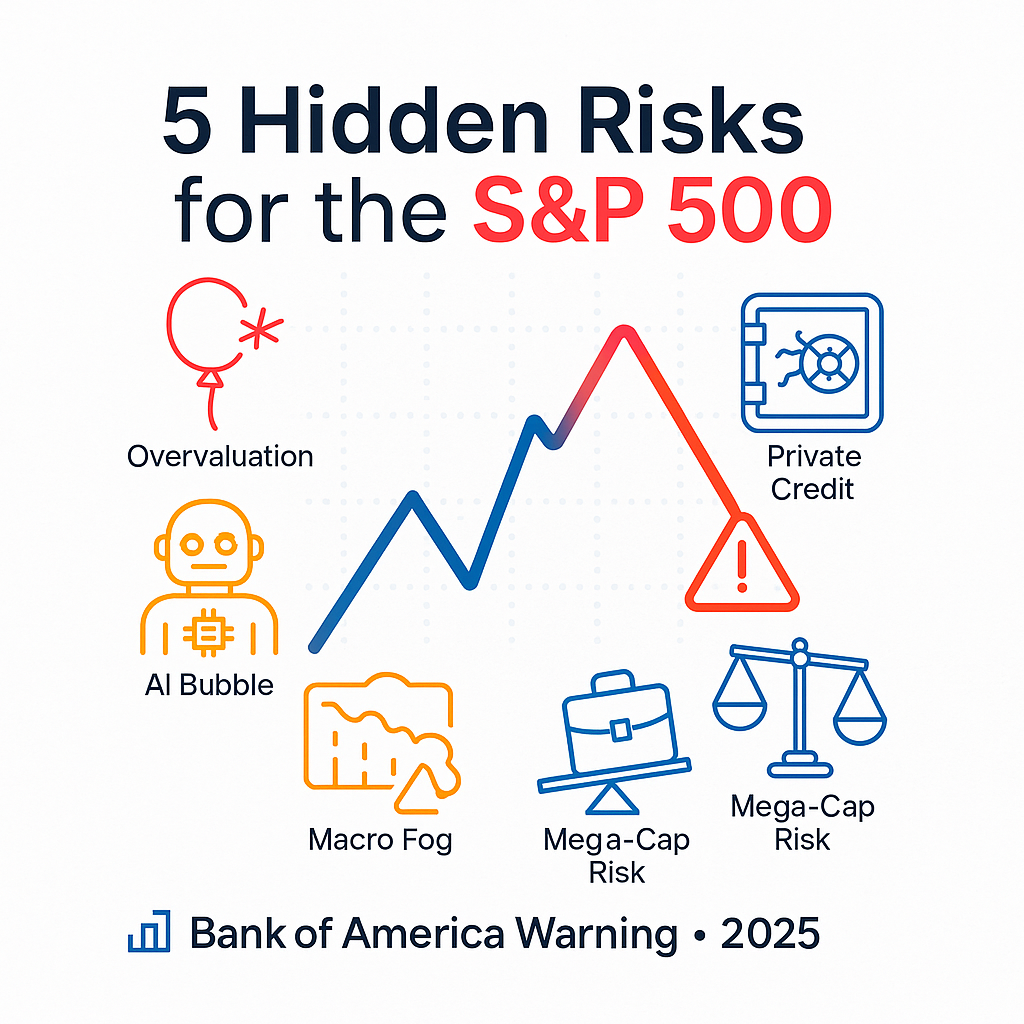

5 Hidden Risks Bank of America Warns Could Shake the S&P 500 in 2025

Bank of America highlights five hidden risks that could threaten the S&P 500 in 2025 — from overvaluation and AI bubble risk to private credit stress. Learn what investors should do now.

Key Takeaways

✔ Bank of America says nearly 60 percent of its key valuation indicators for the S&P 500 are flashing warning signs.

✔ The five major risks: overvaluation, AI and consumer slowdown, mega-cap concentration, macro fog, and private credit cracks.

✔ For long-term investors, managing downside risk matters as much as chasing short-term gains.

The U.S. stock market continues its remarkable rally into 2025.

Fueled by AI investment and tech earnings, the S&P 500 has hit fresh highs and investor sentiment remains strong.

But Bank of America (BoA) is urging caution.

In its latest report, BoA warns that “beneath the surface of the rally lie five key risks” and that nearly 60 percent of valuation metrics are already at overheated levels.

For investors in their asset-building years (ages 25 to 44), these hidden risks could define whether 2025 becomes a year of steady growth or sudden correction.

Overvaluation Flashing Red — A Bubble Warning on the Horizon

BoA finds that 12 out of 20 valuation metrics for the S&P 500 — including P/E ratios, price-to-book ratios, and the market-cap-to-GDP ratio — are at historically extreme levels.

This pattern mirrors the early 2000s dot-com bubble, where optimism outran earnings.

Today’s market is driven more by expectations than fundamentals, making it vulnerable to a sentiment shift.

When price momentum outpaces profit growth, a single disappointing quarter can trigger sharp corrections across major indexes.

Investors should avoid chasing high valuations and instead focus on gradual entry and cash reserves.

The AI Boom’s Shadow — Consumer Slowdown and Restructuring Ahead

The AI investment boom has helped U.S. GDP stay resilient, but its benefits are uneven.

Automation and efficiency gains can lead to labor cuts and weaker household spending.

BoA notes that while AI increases productivity in the short term, it may dampen consumer demand over time.

Nearly half of S&P 500 companies have moderate to high AI exposure, representing more than $20 trillion in market cap. (Tom’s Hardware)

If AI stocks stumble or revenue fails to meet expectations, the domino effect could ripple through the entire index.

Mega-Cap and Private Capital Concentration — A Complex System of Interlinked Risks

Just ten mega-cap stocks now account for more than 35 percent of the S&P 500’s total weight.

That means market momentum is increasingly tied to a handful of companies.

BoA warns that this concentration is further compounded by government subsidies, private equity capital, and the rapid growth of private credit markets.

When one large company misses earnings, it doesn’t just drag down its sector — it can distort ETF flows, bond yields, and derivative pricing simultaneously.

This “interlinked ecosystem of risk” makes market diversification and mid-cap exposure more important than ever for individual investors.

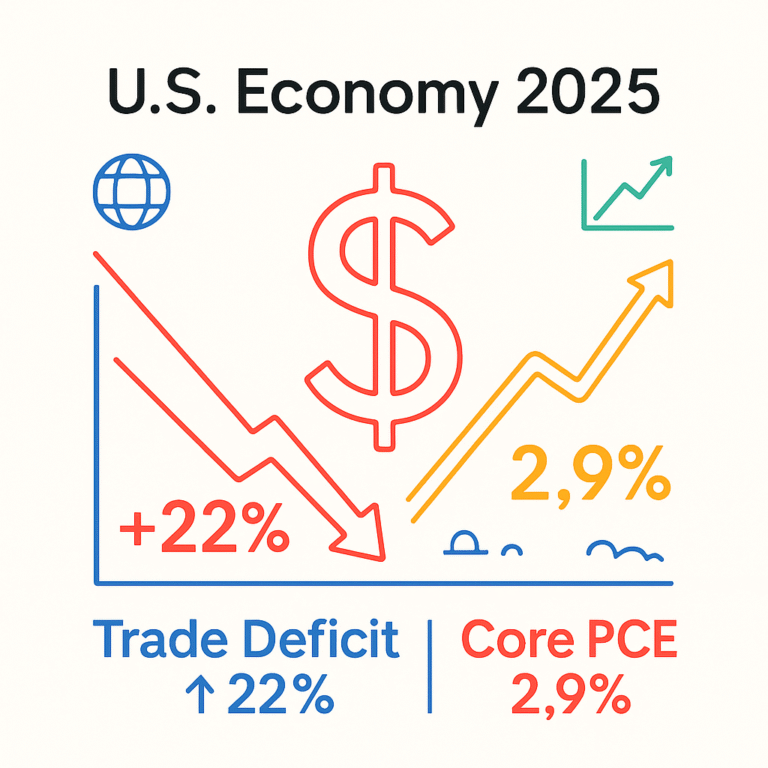

Macro Fog — When Data Blackouts Cloud Market Judgment

The ongoing U.S. government shutdown has delayed key economic reports on jobs, inflation, and manufacturing.

This lack of fresh data has created what BoA calls a “Macro Fog.”

Without reliable indicators, traders and policymakers are forced to navigate blindly.

That uncertainty raises volatility and can magnify overreactions to any new headline or rumor.

For retail investors, this means focusing less on short-term forecasts and more on sound allocation principles — cash buffers, staggered entry points, and geographical diversification.

“Cockroach Risk” — Cracks in the Private Credit Market

BoA’s final warning centers on the rapidly expanding private credit market, now worth around $700 billion.

While these non-bank loans have filled a financing gap, they are opaque and lightly regulated.

“If you see one crack, there are probably many more behind it — like cockroaches,” BoA analysts wrote. (Business Insider)

A failure in this sector could force index funds to sell stocks to cover losses, amplifying market stress. (Bloomberg)

In short, a liquidity problem in private credit could cascade into a broader equity sell-off — a classic contagion scenario.

S&P 500 Risks and Investor Responses

|

Risk Type |

Description |

Current Status |

Investor Response |

|---|---|---|---|

|

Overvaluation |

60% of valuation metrics flashing red |

Near historic highs |

Use dollar-cost averaging and hold cash reserves |

|

AI and Consumer Slowdown |

Half of index highly AI-exposed |

Spending power waning |

Trim consumer cyclical exposure |

|

Mega-Cap Concentration |

Top 10 stocks = 35% of index |

Dependence deepening |

Add mid-cap and value positions |

|

Macro Fog |

Economic data delays |

Forecast uncertainty |

Diversify globally and raise risk thresholds |

|

Private Credit Cracks |

Liquidity and default risks |

Spreading concerns |

Favor high-liquidity assets |

What to Watch Next — Three Signals That Will Shape 2025

Bank of America points to three key signals investors should track closely:

- AI earnings momentum — Will revenue growth justify sky-high valuations?

- Private credit default rates — A leading indicator of financial stress.

- Return of economic data — When the Macro Fog lifts, market pricing may reset.

Treat these as your risk dashboard.

Checking them monthly can help identify turning points before they hit the headlines.

The S&P 500 looks healthy on the surface, but Bank of America’s five hidden risks suggest that the foundation is less solid than it appears.

Overvaluation, AI fatigue, and private credit cracks can all unravel a rally built on momentum.

For individual investors, 2025 should be about balance — not fear.

- Reassess your portfolio now.

- Raise cash buffers, add defensive ETFs like gold or utilities, and focus on quality earnings.

References

- Business Insider — “Macro fog and credit cockroaches are among the top 5 risks to the S&P 500”

- MarketWatch — “Here are 5 mounting risks that could hurt the S&P 500, according to BoA”

- Tom’s Hardware — “S&P 500 companies with AI exposure worth $20 trillion”

- Bloomberg — “BoA warns of forced stock selling if credit problems persist”