7 Key Insights: Comparing Micro-Investing Platforms in the U.S. vs Europe for Beginners in 2025

Compare U.S. and European micro-investing platforms in 2025. Learn about fees, regulations, features, and growth outlook in this beginner-friendly guide.

Key Takeaways

• Global micro-investing market projected to grow from $1.12B in 2024 to $3.36B by 2033

• North America holds over 40% market share, with U.S. apps leading in accessibility and innovation

• Robinhood, Acorns, and Webull dominate the U.S. market

• Europe faces complex fee structures and regulations, requiring careful navigation

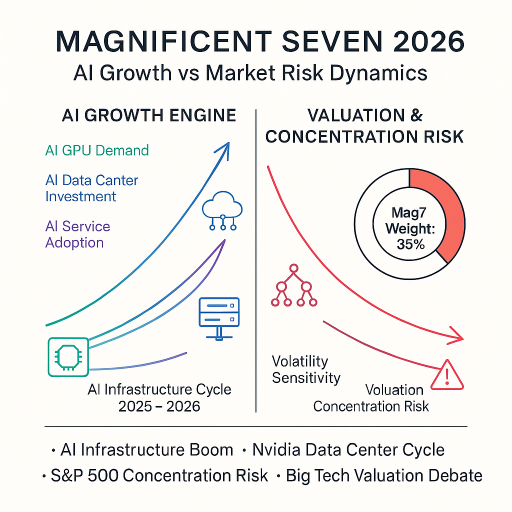

• AI personalization and stronger security will shape the next wave of platform competition

Micro-investing has transformed the way beginners enter the financial markets. By lowering the threshold to just a few dollars or euros, these apps are reshaping personal finance. In 2024, the global micro-investing market was valued at roughly $1.12 billion and is forecast to expand to $3.36 billion by 2033 (Business Research Insights). North America accounts for more than 40% of this market, underscoring the dominance of U.S. platforms. This article compares the leading apps in the U.S. and Europe, highlighting what beginners should know before choosing a platform.

Origins and Growth of Micro-Investing

The concept of micro-investing started with the goal of democratizing finance. Apps like Acorns, which rounds up spare change into investments, and Robinhood, which pioneered commission-free trading, broke down traditional barriers to entry. These tools encouraged Millennials and Gen Z investors to participate in the markets at unprecedented levels, fueling rapid global growth.

Market Size and Growth Rates: U.S. vs Europe

The U.S. market has expanded rapidly under the oversight of the SEC, offering straightforward fee structures and a dynamic fintech ecosystem. North America captured over 40% of global market share in 2023. Europe, by contrast, is still in an earlier stage, with regulations varying across countries. While this slows adoption, stronger ESG investing trends and digital asset frameworks are expected to create long-term growth opportunities.

U.S. Leaders: Robinhood, Acorns, and Webull

- Robinhood: Clean interface, commission-free trading, highly popular among Millennials and Gen Z

- Acorns: Known for automatic round-up investing, ideal for cultivating long-term habits

- Webull: Offers advanced charts, analytics, and real-time data, appealing to intermediate investors

European Players: Revolut, Trading212, and Scalable Capital

- Revolut: A “super-app” combining payments, transfers, and investments in one platform

- Trading212: Provides commission-free stock and ETF trading, highly accessible for beginners

- Scalable Capital: A robo-advisor model that emphasizes diversified, long-term portfolios

U.S. vs Europe Micro-Investing Platform Comparison

|

Category |

United States |

Europe |

|---|---|---|

|

Leading Platforms |

Robinhood, Acorns, Webull |

Revolut, Trading212, Scalable Capital |

|

Market Share |

40%+ of global market (2023) |

Early growth stage, varies by country |

|

Entry Barriers |

As low as $1 investment |

As low as €1, depending on local rules |

|

Fee Structure |

Robinhood: free, Acorns: subscription model |

Revolut: tiered fees, Trading212: free |

|

Regulatory Oversight |

SEC (U.S. Securities and Exchange Commission) |

FCA (UK), BaFin (Germany), other national bodies |

|

Assets Offered |

U.S. stocks, ETFs, some crypto |

European stocks, ETFs, robo-advisory |

|

User Experience (UX) |

Mobile-first, beginner-friendly |

Multilingual support, integrated financial services |

|

Signature Features |

Round-up investing (Acorns), zero-fee trading (Robinhood) |

All-in-one super-app (Revolut), automated portfolios (Scalable Capital) |

|

Growth Drivers |

Younger demographics fueling adoption |

ESG and digital asset regulation |

|

Key Risks |

Speculative trading, cybersecurity issues |

Tax differences, complex fee structures |

How Fees and Regulations Affect Beginners

For beginners, fees and regulations can make or break the investment experience. In the U.S., simpler structures create a more predictable environment. In Europe, however, the same app may charge different fees or limit services depending on the user’s country of residence. For long-term investors, even minor differences in fees can compound significantly, making transparency and clarity essential.

Expert Perspectives on Market Impact

Bloomberg has called micro-investing “a key driver of financial inclusion,” while the IMF notes that increased retail participation could enhance market stability and liquidity over time. These views suggest that micro-investing is not just a short-term trend but a structural shift in global finance.

What’s Next: AI and Global Expansion

The future of micro-investing lies in personalization and scalability. Platforms are increasingly integrating AI to analyze spending patterns and risk preferences, delivering tailored portfolios. Global expansion will also hinge on multi-currency support, localized compliance, and robust cybersecurity. Regulatory agility will be just as important as product innovation (BrokerChooser).

U.S. and European platforms present distinct strengths and challenges. The U.S. excels in accessibility and variety, while Europe requires careful navigation of regulations and fee structures but holds significant long-term potential. As AI and security become defining features, beginners should choose platforms that balance innovation with regulatory trust.