US Recession Risk 2025 Recovery Outlook: Signs of Slowdown or Path to Growth?

Is the US economy in 2025 facing a slowdown or recovery? Explore the latest data and expert opinions on recession risk and growth outlook.

Key Takeaways

✔ UBS warned the US faces a 93% chance of recession in 2025.

✔ A WSJ survey lowered the recession probability to 33% over the next 12 months.

✔ NBER said the US is not in an official recession but shows “recession-like conditions.”

✔ Mark Zandi pointed to tariffs, immigration limits, and labor weakness as major risks.

✔ AI and healthcare remain key growth drivers supporting the 2025 US economic recovery outlook.

The debate over the US recession risk 2025 recovery outlook has intensified. UBS recently warned of a staggering 93% chance of recession, while a Wall Street Journal survey suggested the probability had fallen to 33%. The National Bureau of Economic Research (NBER) noted that while the US is not technically in recession, the economy shows “recession-like” patterns.

For investors, households, and policymakers, the question is urgent: Is this the start of a prolonged slowdown, or can the US still achieve a recovery in 2025?

How the Recession vs Recovery Debate Evolved in 2025

In the first half of 2025, UBS declared the economy was facing a 93% recession risk, likening it to “a patient with high blood pressure.” This sparked fears of a broad 2025 US economic slowdown.

By mid-year, sentiment improved. A WSJ survey found economists cutting the risk to 33%, pointing to resilient consumer spending and the possibility of stronger job growth. NBER remained cautious, noting that multiple indicators suggest the US economy is in a fragile state resembling a mild recession.

GDP Growth, Jobs, and Inflation Showing Mixed Signals

Real GDP grew at an annualized 3.3% in Q2, with consumer spending, AI, and healthcare fueling the expansion. These sectors remain vital for the US recovery outlook in 2025.

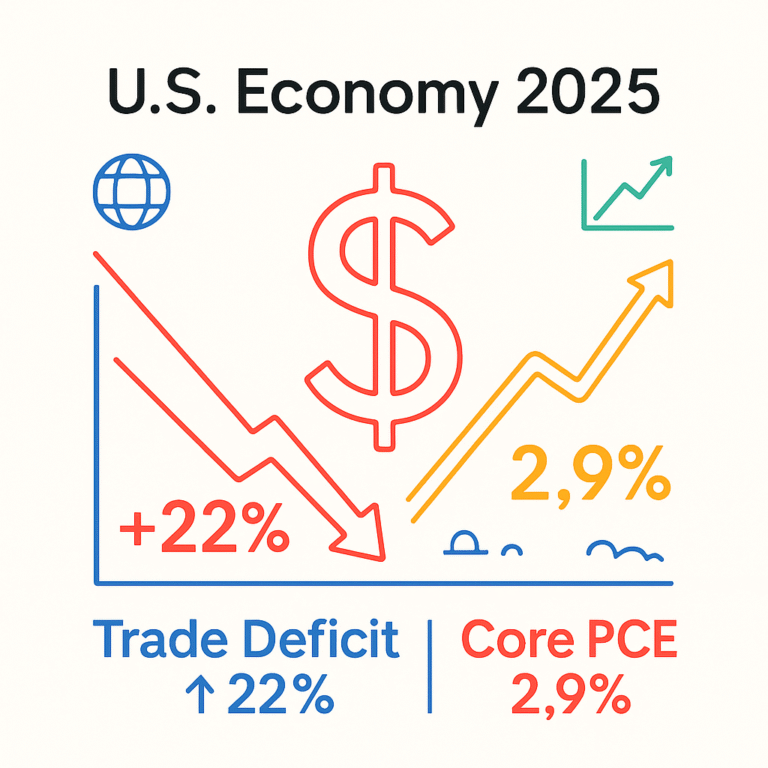

But labor data raised red flags. In August, only 22,000 jobs were added, one of the weakest figures in recent years. Inflation also lingers, with CPI rising 2.9% year-over-year and core CPI holding at 3.1%. This suggests the Federal Reserve may remain cautious before cutting rates.

Experts Divided on Recession Risk vs Recovery Chances

UBS economists remain skeptical, warning of extended weakness. Moody’s economist Mark Zandi stressed that tariffs and immigration restrictions are raising costs and hurting the labor market, raising the likelihood of a downturn.

On the other hand, many economists in the WSJ survey highlight consumer resilience, robust tech earnings, and the Fed’s potential easing as reasons to support the 2025 US economic recovery outlook.

Recession Risk vs Recovery Outlook: Side-by-Side Comparison

|

Factor |

Recession Scenario |

Recovery Scenario |

|---|---|---|

|

GDP Growth |

Slows below 1% by late 2025 |

Holds steady around 2–3% |

|

Labor Market |

Job growth remains weak (under 50k monthly) |

Hiring rebounds in services and tech |

|

Inflation |

Stays sticky near 3%+ |

Gradually eases toward Fed’s 2% target |

|

Key Risks |

Tariffs, immigration limits, consumer debt |

Policy easing, tech & healthcare demand |

|

Market Impact |

Defensive assets gain, equities pressured |

Stocks rally, bond yields ease |

|

Global Effect |

US slowdown drags on Europe and Asia |

Stronger US demand supports global trade |

This comparison helps frame the 2025 US economic slowdown vs recovery debate. Both scenarios remain possible depending on policy choices and external shocks.

Key Variables That Will Shape the 2025 US Economy

Several factors will decide whether the US recession risk 2025 recovery outlook leans toward slowdown or growth:

- Federal Reserve policy – If inflation eases further, September rate cuts could accelerate.

- Trade and immigration policies – Shifts here will influence labor supply, costs, and growth potential.

- Sector resilience – AI and healthcare remain strong, but without support from manufacturing and construction, recovery could be fragile.

The US recession risk 2025 recovery outlook shows an economy balancing between warning signs and growth potential. Officially, the US has avoided recession, but labor weakness, sticky inflation, and policy risks persist.

At the same time, strong consumer spending and technology-driven growth keep optimism alive.

Reference Links

- UBS recession warning: ainvest.com

- WSJ survey, 33% recession odds: wsj.com

- NBER “recession-like” analysis: ft.com

- GDP and consumer spending: usbank.com

- Jobs and inflation data: marketwatch.com

- Tech and healthcare resilience: barrons.com

- Mark Zandi’s warning: businessinsider.com