Why the Fed’s First Rate Cut of 2025 Matters for New Investors – Opportunities and Risks

The Fed’s first rate cut of 2025 explained: why it happened, how it affects loans, savings, and investments, and what new investors should watch closely.

Key Takeaways

✔ The Fed lowered rates by 0.25% to 4.00-4.25% in September 2025

✔ Inflation stands at 2.9%, still above the 2% target, while job growth is slowing and unemployment is ticking up

✔ Lower borrowing costs and opportunities in housing and growth stocks emerge, but savings yields fall and inflation risks remain.

Why the September 2025 Rate Cut Signals a Shift

The Fed rate cut September 2025 marked the first move in nine months, reducing rates to 4.00–4.25%. For beginner investors, this is more than a policy shift. It sets the tone for how borrowing, saving, and investing will play out through the rest of the year.

Inflation remains at 2.9%, above the Fed’s 2% goal, while job growth is weakening. This combination pushed policymakers toward easing, making the 2025 Fed interest rate cut a turning point that new investors need to understand.

How the Fed Reached Its First Rate Cut in 2025

The Fed’s decision to cut rates in September came after holding steady since December 2024. Throughout early 2025, inflation stayed stubborn while the labor market softened.

|

Period |

Fed Funds Rate |

Key Notes |

|---|---|---|

|

Dec 2024 |

4.25–4.50% |

Last cut before a long pause |

|

Jan–Aug 2025 |

4.25–4.50% |

Rates held steady, data mixed |

|

Sep 17, 2025 |

4.00–4.25% |

First cut, reflecting labor weakness |

This timeline shows why the U.S. interest rate cut strategy for beginner investors should consider both inflation and employment trends, not just one factor.

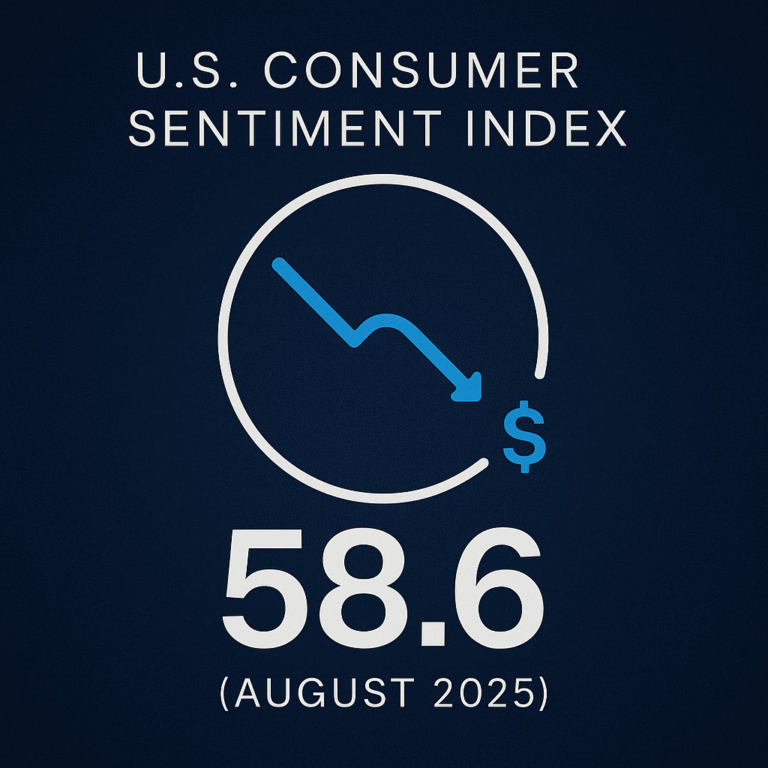

Inflation, Jobs Data, and Market Reaction

Inflation in August hit 2.9%, compared with 2.7% in July. At the same time, unemployment rose slightly as job creation slowed.

Markets reacted quickly. Large banks lowered prime lending rates, reducing credit card and mortgage rates after the Fed rate cut. Stock markets saw gains in real estate and growth sectors, while broader sentiment stayed cautious.

How Powell and Analysts Interpret the Cut

Fed Chair Jerome Powell said job gains have slowed and unemployment has inched higher, warning of downside risks. Analysts at Goldman Sachs predict two more cuts this year, but opinions inside the Fed remain split.

This uncertainty means what the Fed’s 2025 rate cut means for new investors is not a one-way bet. Policy may shift again if inflation proves sticky or growth slows further.

Opportunities and Risks for New Investors

The first Fed rate cut of 2025 brings both advantages and risks for wealth-building beginners.

Opportunities

- Lower borrowing costs: Cheaper credit cards, auto loans, and mortgages reduce financial stress.

- Housing opportunities: Falling mortgage rates create chances to buy or refinance.

- Growth stock rebound: Tech and innovation firms, pressured by high rates, may recover.

Risks

- Lower savings yields: CDs and savings accounts deliver weaker returns.

- Persistent inflation: Prices at 2.9% could erode purchasing power.

- Policy uncertainty: The Fed’s path forward is unclear, keeping volatility high.

What’s Next: Key Dates and Investor Checklist

The coming months will be critical for investors adapting to the September 2025 rate cut.

|

Factor |

Timeline |

Investor Strategy |

|---|---|---|

|

Next FOMC Meetings |

Oct & Dec 2025 |

Watch for more cuts; plan borrowing and investment timing |

|

Inflation Data |

Monthly CPI, PCE |

Adjust bond and stock allocations based on trends |

|

Labor Market Reports |

Monthly jobs data |

Track job stability; consider defensive sectors |

|

Loan & Savings Rates |

Ongoing bank changes |

Pay down high-interest debt, diversify savings |

The Fed rate cut September 2025 is a double-edged sword for new investors. It lowers borrowing costs and opens opportunities in housing and growth stocks. But it also reduces savings yields and leaves inflation risks unresolved.

Now is the time to manage debt, rebalance portfolios, and plan for long-term strategies that account for both easing cycles and potential economic slowdowns.