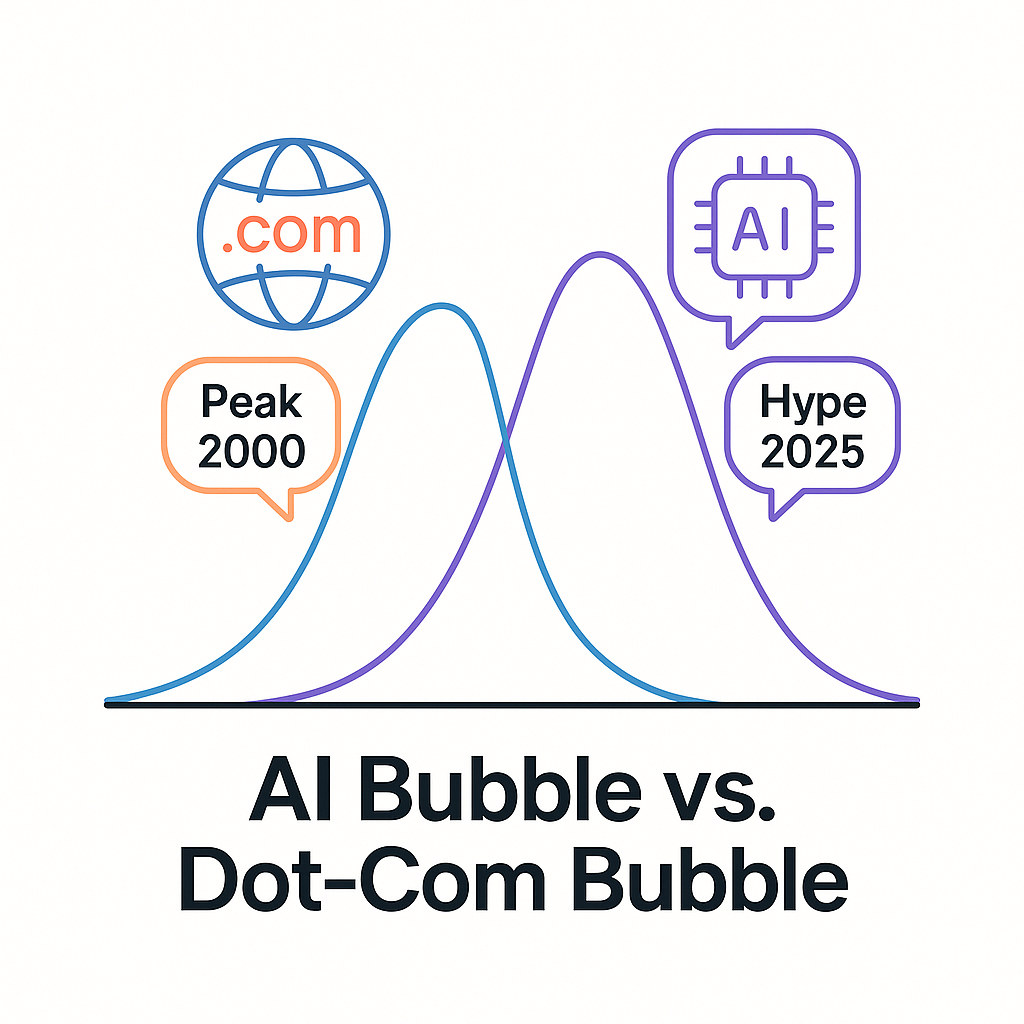

AI Bubble Debate: Comparing the Dot-Com Crash and Today’s AI Investment Boom

Is the AI boom becoming the next dot-com bubble? This analysis compares today’s AI valuation, investor behavior, and market risks to early-2000s tech mania.

Key Takeaways

✔ The AI market shows familiar signs of “irrational exuberance” seen during the dot-com bubble.

✔ Yet its revenue models and infrastructure base are far more mature.

✔ The key imbalance lies between “expectation speed” and “monetization speed.”

✔ Smart investors should track valuation metrics, cash flows, and market sentiment.

Is the AI Boom Turning Into a Bubble?

As of 2025, seven of the world’s ten largest companies by market cap are tied to artificial intelligence.

That ratio mirrors the late-1990s dot-com peak, when investors believed the Internet would redefine everything.

The Wall Street Journal notes that “AI-related capital inflows are growing even faster than during the dot-com era.”

The big question now: Is this a speculative bubble—or a true turning point in technological history?

This article explores the parallels and contrasts between the dot-com crash and today’s AI surge, combining market data, valuation metrics, and investor psychology.

How the Dot-Com Bubble Formed: When Expectations Outran Reality

Between 1995 and 2000, investors bet heavily on the promise of the Internet.

Stock prices soared simply because a company had “.com” in its name.

The Nasdaq hit 5,048 points in March 2000 before collapsing by 78% in just two years.

Economist Robert Shiller, in Irrational Exuberance, described the phenomenon as a feedback loop between optimism and asset prices.

Capital flooded in faster than real profits could appear—expectations expanded far beyond monetization.

The result: a historic boom that turned into a brutal correction.

The 2025 AI Investment Boom: Capital Is Moving Faster Than Technology

According to the World Economic Forum, global AI investment surpassed $2 trillion by mid-2025.

Massive spending on generative AI, large language models (LLMs), and semiconductor infrastructure is driving valuations higher.

Yet Forbes reports that nearly 70% of AI startups still lack positive cash flow.

That echoes the “growth without profit” dynamic of 1999.

Investors are chasing future dominance rather than present earnings—capital is outpacing the speed of technological maturity.

Comparing the AI Boom and Dot-Com Bubble: Six Key Differences

|

Category |

Dot-Com Bubble (1995–2000) |

AI Boom (2023–2025) |

|---|---|---|

|

Core Tech Trend |

Internet & e-commerce |

Generative AI & LLMs |

|

Main Investors |

Venture capital & IPOs |

Big Tech + Private Equity + Sovereign Funds |

|

Revenue Model |

Ad-based traffic |

Cloud subscriptions & API usage fees |

|

Valuation (PER) |

100× + (no profits) |

40–60× (with some profits) |

|

Market Leaders |

Startups |

Large tech firms (Microsoft, NVIDIA) |

|

Risk Factors |

Cash burn & IPO collapse |

GPU supply limits & regulation |

Both eras share excessive optimism, but AI’s foundation is different.

Unlike the “idea bubble” of the early Internet, today’s AI boom is backed by physical infrastructure and data assets that carry long-term value.

Valuation Metrics Reveal Signs of Overheating

Bloomberg estimates that by mid-2025, the top five AI companies—NVIDIA, Microsoft, Alphabet, Amazon, and OpenAI—were worth $14 trillion, or 28% of the S&P 500’s total market cap.

That exceeds the 26% concentration reached at the height of the dot-com bubble.

Research Affiliates notes that AI stocks now trade at an average Price-to-Sales ratio of 14, nearly triple their historical norm.

Still, Morgan Stanley argues the surge may represent a “Productivity Bubble”—a phase where short-term exuberance leads to long-term efficiency gains.

In other words, not all bubbles end in destruction; some reshape productivity and profit cycles.

Investor Psychology: Herd Behavior and the FOMO Effect

At the heart of every bubble lies human emotion.

AI investors share a powerful FOMO—Fear of Missing Out—that fuels herd behavior and self-reinforcing rallies.

Stocks rise not only on fundamentals but also on fear of being late.

When narrative momentum exceeds real progress, the gap between valuation and earnings widens.

Today’s market is replaying the same pattern seen in 1999: expectations accelerate faster than revenue growth can catch up.

Risk Triggers That Could Burst the AI Bubble

1️⃣ Slow monetization: GPU costs and power usage remain high, squeezing margins.

2️⃣ Higher interest rates: Capital costs may rise, pressuring long-duration tech assets.

3️⃣ Regulatory pressure: The EU AI Act and U.S. data-protection laws could tighten growth.

4️⃣ Supply bottlenecks: GPU and chip shortages could delay AI deployment.

Bloomberg Intelligence warns that AI’s return on capital could fall 30% by 2026 if profit growth fails to match current expectations.

History shows that bubbles rarely pop from a single shock—they unravel when optimism fades faster than earnings improve.

Strategic Insights for Investors and Companies

- Stay data-driven: Track AI and semiconductor ETFs by earnings growth and ROE, not hype.

- Monitor cash-flow yields: In 2025, AI firms average 1.4% FCF yield vs 3.8% for the S&P 500.

- Diversify risk: Include infrastructure plays—power, cloud, and chip suppliers—to balance volatility.

- Watch the narrative: When media tone and policy signals diverge from fundamentals, it often marks the turning point.

Selective Corrections, Not Total Collapse

The AI boom undeniably echoes the dot-com bubble’s psychology and valuation patterns.

But this time, real infrastructure, hardware, and monetization pipelines provide a sturdier base.

The coming correction may not be a crash—it may be a selective reset separating sustainable innovation from speculative noise.

The right question isn’t “Is AI a bubble?” but “Which parts of AI will survive the deflation?”

Long-term investors who balance conviction with discipline could find the next decade’s winners among today’s volatility.