Why Morgan Stanley Predicts the S&P 500 Will Reach 7,800 by 2026: A Deeper Look at the +16% Rally Scenario

Morgan Stanley expects the S&P 500 to hit 7,800 by 2026. Here’s how earnings, AI, and valuations support the +16% rally outlook.

Key Takeaways

✔ Morgan Stanley forecasts the S&P 500 rising to 7,800 by 2026, implying a 16% upside.

✔ EPS growth of +17% in 2025 and +12% in 2026 forms the core of the bullish outlook.

✔ AI-driven productivity, early-cycle economic signals, and stable policy conditions support the scenario.

✔ UBS and Jefferies also see 7,500, while Stifel warns of 6,350—highlighting wide dispersion.

✔ Valuation pressure, Fed policy shifts, and uncertain AI ROI remain meaningful risks.

Morgan Stanley’s projection of the S&P 500 reaching 7,800 by 2026 is not merely a bullish headline.

It’s a structured scenario based on accelerating earnings, improving productivity, and a more supportive macro environment.

Despite lingering inflation and high rates over recent years, U.S. companies have maintained strong cost control, reinvested aggressively into digital infrastructure, and expanded AI adoption. These shifts have revived expectations for a durable productivity cycle.

Across Wall Street, consensus is beginning to tilt toward a medium-term U.S. equity leadership phase, even as near-term volatility remains possible.

Below, we break down Morgan Stanley’s logic, compare it with other major houses, and outline what this could mean for global investors.

How Earnings, AI Productivity, and Policy Combine to Support the 7,800 Target

Morgan Stanley’s outlook hinges primarily on the earnings cycle turning upward.

The firm expects S&P 500 EPS to grow +17% in 2025 and +12% in 2026, marking a decisive reversal from recent stagnation.

Two forces guide this confidence:

1) AI-driven efficiency and margin expansion

Companies are increasing automation, cloud investments, and AI adoption. Even if enterprise AI returns remain uneven today, the direction of travel—higher productivity and lower marginal cost—is becoming clearer.

2) A policy environment that avoids over-tightening

Morgan Stanley assumes the Federal Reserve will prioritize economic stability, allowing inflation to cool gradually without aggressively pushing rates higher again.

Together, these factors form the structural foundation of the S&P 500 7,800 scenario, supported by both growth and valuation.

Why Morgan Stanley Believes the U.S. Is Entering an Early-Cycle Expansion

Morgan Stanley characterizes the current environment as an early-cycle phase, supported by tangible improvements in corporate fundamentals rather than macro theory.

Key signals include:

- Roughly 80% of S&P 500 companies beat earnings expectations in late 2025.

- Industrial, tech, and consumer sectors are showing renewed order growth.

- Inventory normalization is giving way to higher production and restocking.

These patterns resemble the early stages of previous recoveries, where industrial stocks, financials, consumer discretionary, and small caps typically lead performance.

This also explains the firm’s call for leadership broadening beyond mega-cap tech in 2026.

Where Morgan Stanley’s 7,800 Forecast Sits Among Wall Street Targets

Comparing major houses shows how widely expectations diverge:

|

Firm |

2026 S&P 500 Target |

Implied Move |

Key Drivers |

Risks |

|---|---|---|---|---|

|

Morgan Stanley |

7,800 |

+16% |

EPS +17%/+12%, AI productivity, early-cycle dynamics |

Valuation, rate volatility |

|

UBS |

7,500 |

+9% |

AI momentum, resilient profits |

Overstretched expectations |

|

Jefferies |

7,500 |

+9% |

Strong multi-year EPS trends |

Repricing risk |

|

Stifel |

6,350 |

-5% |

High valuations, inflation reacceleration |

Renewed tightening |

The takeaway is clear:

Bullish scenarios (7,500–7,800) dominate, but downside paths (6,350) remain credible.

This reinforces the need for multi-scenario planning rather than single-direction positioning.

What a 7,800 S&P 500 Implies for Valuation and AI-Driven Growth

A 7,800 index level isn’t just a prediction—it represents a specific valuation worldview.

PER Check

- Expected 2026 EPS: ~$317

- 7,800 ÷ 317 = ~24.6× forward earnings

This is well above long-term averages (15–17×) and sits near the valuation highs seen during the peak AI-driven rally.

Why AI ROI Is the Decisive Variable

High valuations can persist only if AI investments translate into measurable productivity gains.

If adoption slows or cost savings fail to materialize, the S&P 500 could experience a 10–15% valuation reset.

In short, the 7,800 scenario requires not just economic stability—but a structural improvement in corporate efficiency driven by AI.

What a U.S.-Led Rally Means for Global and Asian Investors

Dollar Path Matters

Morgan Stanley expects U.S. equities to outperform global peers, but also anticipates a mild dollar softening in 2026 after a period of strength.

Historically, Asian and emerging markets outperform during weaker-dollar phases.

Sector-Level Spillovers

A prolonged AI and capex cycle benefits:

- Semiconductors

- Equipment makers

- Cloud infrastructure suppliers

This provides indirect support for Korea, Taiwan, and ASEAN markets tied to global tech supply chains.

Portfolio Positioning Implications

A balanced allocation under the 7,800 scenario may include:

- Core: S&P 500 and Nasdaq ETFs

- Satellite: Asia tech, semiconductors, EV components

- Risk control: Short-duration bonds, high dividend ETFs

- Style shifts: Increased mid-cap and industrial exposure

This structure participates in upside while building resilience against valuation shocks.

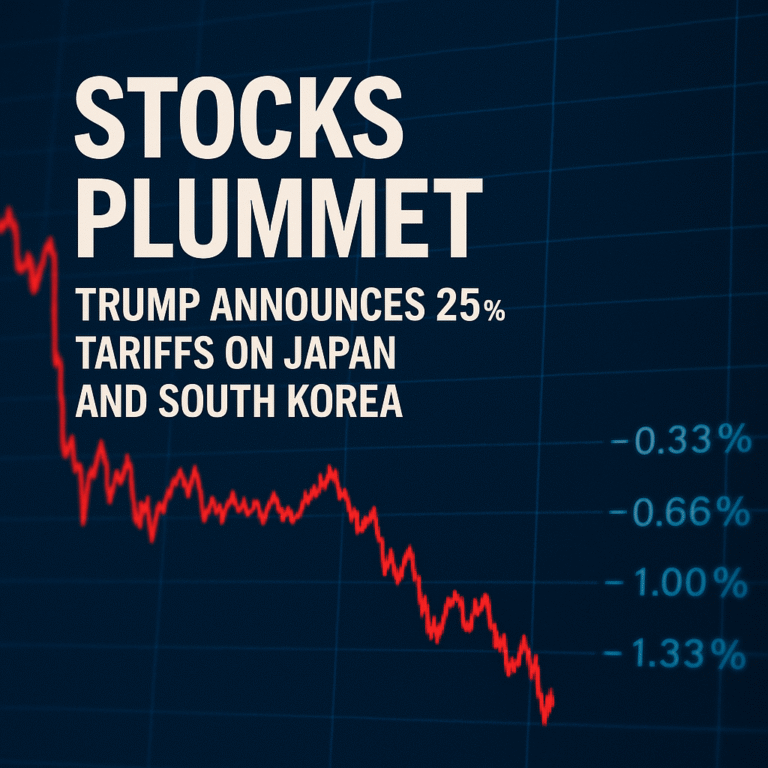

Four Risks That Could Break the 7,800 Scenario

Inflation reaccelerates

Reheating inflation could push the Fed back toward tightening.

AI ROI falls short

Insufficient AI productivity gains would undermine elevated valuations.

Valuation compression

With PER above 24×, even small shocks can trigger 10–15% pullbacks.

Policy and geopolitical uncertainty

Shifts in trade, regulation, or global tensions could destabilize EPS forecasts.

A realistic outlook requires monitoring these variables closely.

The S&P 500 7,800 scenario is built on a powerful combination of improving earnings, AI-driven efficiency, and early-cycle economic signals.

But high valuations and uncertain AI ROI also mean the path ahead will be uneven.

References

- Reuters – Morgan Stanley prefers US stocks over global peers; raises S&P 500 year-end target

- Bloomberg Evening Briefing Americas – Predicting a 16% S&P Rally for 2026

- MarketWatch – Morgan Stanley hikes S&P 500 target for next year. Here are the plays to make.

- Business Insider / AOL Finance – 2 reasons Morgan Stanley sees the S&P 500 spiking 16% next year

- CincoDías / El País – Morgan Stanley no tiene miedo: prevé un alza del 16% del S&P 500 en 2026

- Investing.com – Dollar trajectory and Morgan Stanley asset preferences for 2026

- MIT / Productivity & AI ROI Study Summary