U.S. Jobs Fall by 32,000 and Fed Rate-Cut Odds Hit 89%: What Bond, Stock, and Dollar Markets Reveal About 2026

U.S. jobs fell by 32,000 and Fed rate-cut odds jumped to 89%. Here’s what bond yields, stocks, and the dollar are signaling for 2026.

Key Takeaways

✔ U.S. private payrolls dropped 32,000 in November, signaling labor-market cooling.

✔ Futures markets now price in an 89% chance of a December Fed rate cut.

✔ Treasury yields are falling, tech stocks are rebounding, and the dollar is weakening.

✔ Markets expect a potential multi-step easing cycle into 2026.

✔ Investors must prepare for both soft-landing and recession scenarios.

The latest ADP report showed U.S. private payrolls declining by 32,000 in November, marking a sharper-than-expected slowdown in labor demand. Small businesses drove most of the losses, reinforcing concerns that economic fatigue is building from the bottom up.

At the same time, futures markets assign an 89% probability of a 25-bp Fed rate cut in December, supported by easing wage growth and slowing inflation pressures. Bond yields, equity markets, and the U.S. dollar are already front-running this shift.

The combination of labor-market weakness + rising rate-cut expectations is shaping not only the December market narrative but also the broader 2026 investment outlook.

U.S. Private Payrolls Fall 32,000: A Clear Signal That Labor Demand Is Cooling

ADP data for November revealed a 32,000 decline in private-sector jobs, sharply missing expectations for modest growth. Small businesses (fewer than 50 employees) accounted for roughly 120,000 job losses, reflecting pressure in consumer-facing and interest-sensitive segments.

Wage growth slowed to 4.4% YoY, reinforcing the trend toward softer labor-market conditions. Cooling wage momentum typically leads to softer inflation, giving the Fed more confidence to pivot toward easing.

Because the official BLS report may face delays due to government disruptions, markets are relying more heavily on ADP as a near-term directional signal. For now, the message is clear: the labor market is moving past peak tightness.

Fed Rate-Cut Probability Nears 89%: Markets Treat Easing as the Base Case

Futures markets now price an 89% chance of a 25-bp rate cut at the December 9–10 FOMC meeting. This shift is reinforced by updated forecasts from major institutions:

- J.P. Morgan now expects a December cut after previously assuming a hold.

- BofA Global Research expects a December cut followed by two additional cuts in 2026 (June and July).

Taken together, markets interpret the current environment not as a one-off cut, but as the potential start of a measured easing cycle.

Investors are now positioning around three themes:

- Slowing labor demand

- Easing inflation

- A Fed motivated to prevent a hard landing

These forces explain why risk assets have remained resilient despite weaker job numbers.

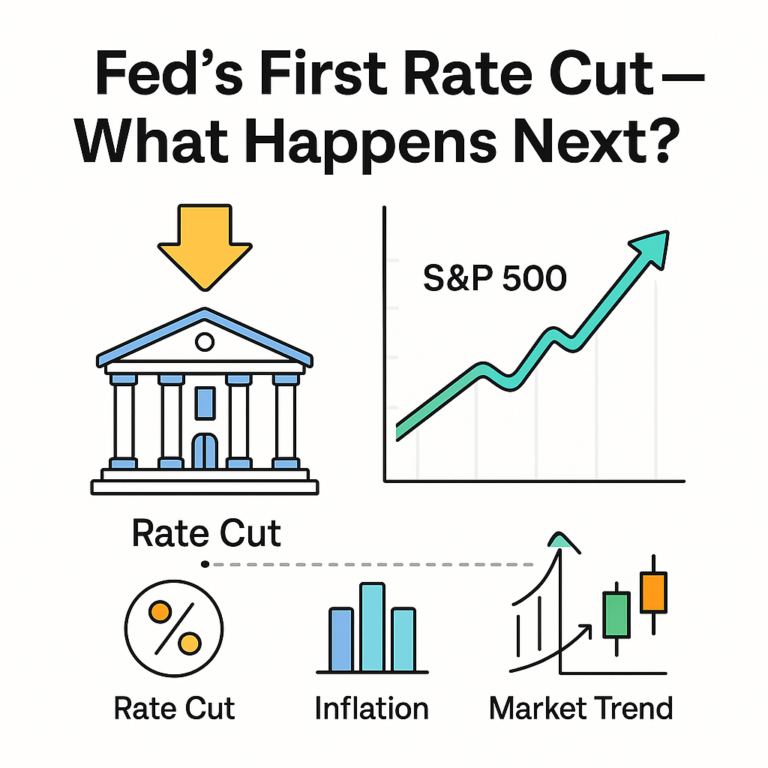

What Bonds, Stocks, and the Dollar Are Already Telling Us

Treasuries: Yields Fall but Long-Duration Faces Structural Headwinds

Ten-year Treasury yields have been falling as traders price in rate cuts.

However, BlackRock maintains a bearish view on long-duration Treasuries, citing:

- Persistent U.S. fiscal deficits

- Increased long-term issuance

- Structural upward pressure from AI-driven investment demand

Short-to-intermediate maturities currently offer a more balanced risk-reward than long bonds.

Equities: Tech and Growth Stocks React First to Falling Discount Rates

Despite softer labor data, the S&P 500 and Nasdaq continue to trade near highs.

This reflects a familiar dynamic: rate-cut expectations reduce discount rates, making long-duration growth assets more attractive.

AI infrastructure spending—semiconductors, cloud, data centers—remains a multi-year tailwind, providing fundamental support beyond the macro narrative.

Dollar and Gold: Broad Dollar Weakness and Firm Gold Prices

The U.S. dollar has fallen about 9% YTD, reflecting narrowing rate differentials and expectations for policy easing. Gold remains strong thanks to:

- Lower real yields

- Safe-haven demand

- Dollar weakness

This combination is typically supportive of international equities, gold ETFs, and emerging-market positions.

Two Distinct Paths for 2026: Soft Landing or Hard Landing

Scenario A: Soft Landing

In this scenario:

- Jobs cool gradually

- Consumption moderates without collapsing

- Inflation continues drifting toward target

- The Fed cuts in December and two more times in 2026

Market implications

- Growth stocks outperform

- Intermediate-term Treasuries benefit

- REITs recover as financing costs fall

- The dollar continues a mild weakening trend

Scenario B: Hard Landing

If ADP, jobless claims, and BLS data deteriorate faster:

- Earnings revisions turn sharply lower

- Consumers pull back more rapidly

- Credit spreads widen

Market implications

- Growth and cyclical stocks face pressure

- Short-term Treasuries outperform

- Gold strengthens

- Defensive sectors—consumer staples, healthcare—gain relative strength

The key variable is speed:

How quickly the labor market weakens will determine which scenario dominates.

What Investors Should Monitor: A Practical Checklist

|

Category |

Current Market Signal |

What to Watch |

Strategy Implication |

|---|---|---|---|

|

Labor Market |

Jobs –32,000, small-biz losses |

ADP, jobless claims, wage growth |

Signals soft vs hard landing |

|

Fed Policy |

89% odds of December cut |

Dot plot, Powell’s tone |

Whether easing becomes a cycle |

|

Bonds |

10Y yields falling |

Yield curve (2s/10s) |

Favor intermediate duration |

|

Equities |

Tech leading rebound |

Earnings revisions |

Balance growth vs defensives |

|

Dollar/Gold |

Dollar weakening, gold firm |

Real yields, broad dollar index |

Global diversification benefits |

This framework helps investors separate the narrative from the data, and weigh market signals against macro developments.

Strategy Guide: Short-Term, Medium-Term, Portfolio Structure

Short-Term (December–January)

- Expect volatility around the FOMC meeting.

- Tech may rally, correct, then resume strength.

- Bonds: intermediate maturities preferred over long duration.

Medium-Term (First Half of 2026)

- Labor-market data will drive sentiment swings.

- AI and semiconductor demand remains structurally strong.

- Dollar weakness may favor global and EM ETFs.

Portfolio Construction: A Barbell Approach

A balanced barbell approach helps hedge both scenarios:

Growth bucket

- AI, semiconductors, cloud, REITs

Defensive bucket

- Short-term Treasuries, gold, consumer staples, healthcare

This structure performs across soft-landing and recession risks.

The combination of –32,000 private-sector jobs in November and 89% odds of a December rate cut signals that the U.S. economy is entering a decisive transition phase. Markets are already pricing in a softer Fed stance, while the labor market hints at emerging vulnerabilities.

Investors should position for both potential paths—soft landing or hard landing—by combining growth exposure with defensive hedges.

References

- Reuters — “US private payrolls unexpectedly decrease in November, ADP says” (Dec 3, 2025)

- Reuters — “Stocks rise on Fed rate cut optimism, US yields drop” (Dec 3, 2025)

- Reuters — “Equities rise on Fed rate cut optimism, Boeing jumps” (Dec 2, 2025)

- Reuters — “Stocks advance, US yields retreat on heightened Fed cut expectations” (Nov 25, 2025)

- Reuters — “US stocks climb on Fed rate cut optimism, Boeing surges” (Dec 2, 2025)