Why the S&P 500 Is Hovering Near Record Highs Ahead of the Fed’s Third Rate Cut — Is the Rally Getting Ahead of Itself?

The S&P 500 is approaching record highs ahead of the Fed’s third rate cut. Here’s what valuations, earnings, and liquidity say about the rally’s durability.

Key Takeaways

✔ The S&P 500 is trading near record highs as markets price in a third consecutive 25 bps Fed rate cut.

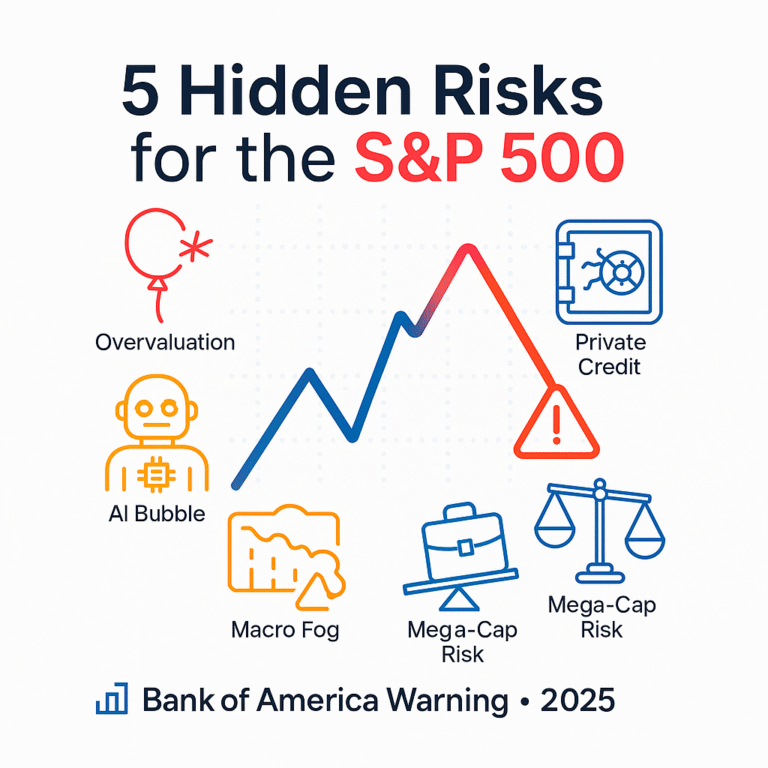

✔ Forward P/E ratios have climbed above long-term averages, raising concerns about stretched valuations.

✔ Earnings growth and strong liquidity inflows continue to support the rally despite valuation risks.

✔ Investors should prepare for potential volatility as the Fed outlines its 2026 rate path.

The S&P 500 is once again pushing toward record territory as the Fed prepares for its December meeting. Markets now assign an 85–87% probability to another 25-basis-point rate cut, strengthening expectations that a full easing cycle may continue into 2026.

Cooling inflation data and softer labor indicators added momentum to the rally. Meanwhile, AI megacaps and cyclical sectors have driven broad gains across the index.

But as the index trades near all-time highs, investors are increasingly asking whether the market is extending beyond fundamentals—or whether the rally reflects a durable shift driven by earnings growth and liquidity.

This article analyzes the drivers behind the S&P 500’s surge, valuation risks, the Fed’s policy trajectory, and what investors should prepare for in the coming months.

Rate-Cut Expectations Are the Core Driver Behind the S&P 500 Rally

The main force behind the recent upswing is the market’s conviction that the Fed will cut rates for a third consecutive meeting.

The probability of a December rate cut has surged to nearly 90%, driven by:

- Moderating inflation

- Slowing job growth

- Rising recession-avoidance confidence

- A stronger outlook for 2025–2026 liquidity conditions

However, the market’s reaction will depend less on whether the Fed cuts rates and more on how far it signals cuts could extend into 2026.

This is why investors are paying closer attention to the updated dot plot and Chair Powell’s tone rather than the cut itself.

At this stage, a cut is expected.

The path after this cut is what matters.

Three Forces Supporting the Market: Earnings, Liquidity, and Sentiment

1) Earnings Momentum

Consensus estimates call for roughly 11–12% EPS growth in 2025, with further expansion expected in 2026.

AI infrastructure, cloud spending, and consumer stability remain key contributors to these forecasts.

As long as earnings expectations remain intact, elevated forward P/E ratios may stay justified—at least temporarily.

2) Strong Liquidity Inflows

A growing volume of capital is positioned to rotate into equities as rates decline:

- Money-market funds holding record cash

- Pension and insurance flows shifting back into risk assets

- Global funds re-entering the US market

- AI-related spending cycles boosting institutional demand

This “liquidity wave” has been repeatedly highlighted by Wall Street analysts as one of the most powerful—yet underappreciated—drivers of the current rally.

3) A Reinforced FOMO Cycle

With the S&P 500 and Nasdaq up double digits this year, investor sentiment has tilted toward fear of missing out.

AI megacaps, in particular, have fueled benchmark-level performance, pushing passive flows higher and reinforcing momentum across large-cap indices.

Where the Market Stands Now: A Snapshot of Key Metrics

|

Indicator |

Recent Level (Dec 2025) |

Interpretation |

|---|---|---|

|

S&P 500 Index |

6,850–6,900 range |

Near all-time highs; pricing in rate cuts |

|

Fed Cut Probability |

85–87% |

Cut expected; guidance more important |

|

Forward P/E (12-mo) |

21.5–22.5x |

Above historical averages; valuation pressure |

|

Trailing P/E |

28–31x |

Elevated levels tied to megacap strength |

|

2025 EPS Growth Outlook |

+11–12% |

Earnings expansion supports high valuations |

The picture is mixed:

- Bullish: earnings growth + liquidity + AI cycle

- Bearish: stretched valuations + Fed uncertainty

This balance explains why the index can climb toward record highs even as concerns about overvaluation grow louder.

The Fed’s Internal Divide: A Hidden Variable That Could Move Markets

One under-discussed risk is the widening divide within the Federal Reserve.

Some policymakers argue for continued easing due to weakening labor data, while others highlight stickier components of inflation and resist additional cuts.

If the Fed:

- cuts rates but signals fewer future cuts, or

- delivers a “dovish cut” with a “hawkish tone”,

the S&P 500 could face short-term volatility.

Markets often rally into a well-anticipated cut—then weaken afterward when the policy path becomes more uncertain.

This makes the December meeting one of the most consequential of the year.

What Investors Should Do Now: Strategy for a High-Valuation Market

Short-Term (Next 1–6 Months)

- Expect volatility around the FOMC announcement.

- Avoid oversized positions based solely on rate-cut optimism.

- Watch megacap tech earnings closely—they remain the market’s backbone.

- Protect gains if your portfolio is heavily weighted toward AI leaders.

A rate cut may not automatically translate into near-term upside.

Long-Term (1–3 Years)

Despite valuation risks, the long-term outlook for US equities remains constructive.

Effective long-term strategies include:

- Staying invested through broad S&P 500 ETFs

- Increasing exposure to quality, dividends, and defensive sectors

- Diversifying beyond megacaps into industrial, fintech, and infrastructure themes

- Maintaining cash or short-term bonds to manage volatility and create buying opportunities

The key is balancing upside participation with risk control in an environment where valuations already assume a smooth soft landing.

The S&P 500’s surge toward record highs reflects a powerful mix of expected Fed rate cuts, strong earnings momentum, and abundant liquidity.

But high valuations, policy uncertainty, and concentrated market leadership suggest that the rally is not without risk.

Rather than chasing short-term momentum, investors should focus on disciplined portfolio construction—aligning allocations with both long-term growth themes and the possibility of intermittent volatility as the Fed clarifies its 2026 rate path.

The coming months will determine whether this rally becomes the start of a multi-year cycle or simply a peak formed by optimism ahead of policy easing.

References

- Reuters, “Wall St closes with slight gains as data keeps Fed cut expectations on track” (Dec 5, 2025)

- Yahoo Finance, “Crucial Fed decision looms as stocks fly high near records” (Dec 7, 2025)

- Fortune, “Facing a vast wave of incoming liquidity, the S&P 500 prepares to surf to a new record high” (Dec 5, 2025)

- MarketWatch via Morningstar, “The Fed meeting this week will determine if investors get new all-time highs or coal for Christmas” (Dec 7, 2025)

- James Investment, “Market Commentary – December 2025” (Dec 2025)

- DWS, “S&P 500 EPS Tracker” (Q3 2025)

- StreetStats, “Stock Market Valuation – S&P 500” (Dec 3, 2025 기준)

- Advisor Perspectives, “P/E10 and Market Valuation: November 2025”

- Business Insider, “Get ready for the S&P 500 to rip 18% higher in 2026”

- Reuters, “BNP Paribas sees S&P 500 ending next year at 7,500”