Is the Magnificent Seven Still Undervalued in 2026? Why Wall Street Keeps Buying Nvidia and Big Tech

Wall Street still favors the Magnificent Seven. Here’s why Nvidia and Big Tech are seen as undervalued despite rising AI bubble concerns.

Key Takeaways

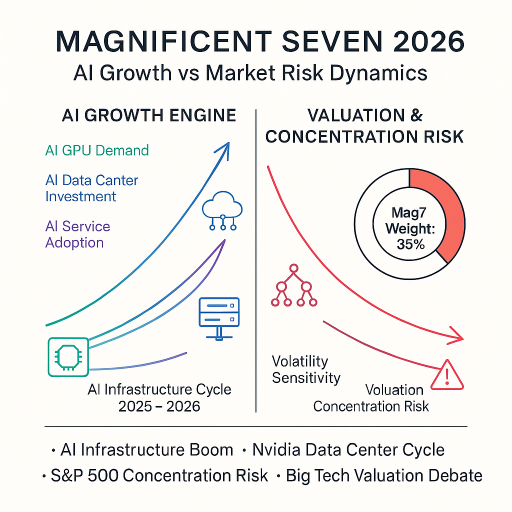

✔ The Magnificent Seven now represents ~35% of the S&P 500, pushing market concentration to historic highs.

✔ Alphabet leads 2025 M7 performance, while Nvidia’s AI infrastructure demand continues to exceed expectations.

✔ Wall Street warns of AI-driven concentration risk, yet expects AI capex and cloud spending to remain strong into 2026.

✔ Investors may benefit from a “growth core + diversified satellite” strategy rather than equal-weight exposure to all seven stocks.

The Magnificent Seven stocks—Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia, and Tesla—continue to dominate the U.S. equity landscape in 2025. Together, they now account for roughly 35% of the S&P 500’s market cap, a level that raises both optimism and concern among investors.

Performance within the group has diverged. Alphabet has surged more than 60% year-to-date, while Nvidia remains the strongest beneficiary of the AI infrastructure boom. Others, including Apple and Tesla, have lagged due to weaker growth visibility and limited AI leverage.

At the same time, Wall Street is increasingly divided. Some analysts warn of an AI bubble, while others argue that Big Tech remains undervalued relative to long-term earnings power. This article explains why many firms still see upside—and how investors can position themselves heading into 2026.

Market Concentration: Why the Magnificent Seven Dominate the S&P 500

The Magnificent Seven’s enormous weight inside the S&P 500 is more than a price-driven anomaly. It reflects structural shifts in the tech and AI economy.

First, platforms built on cloud computing, digital advertising, and AI services benefit from massive operating leverage. As revenue scales, incremental costs remain low, allowing profits to concentrate in a handful of dominant firms.

Second, the AI capex cycle has accelerated sharply. Investment in data centers, GPUs, large language models, and cloud infrastructure explains a majority of S&P 500 earnings and capex growth. This cycle naturally channels capital toward firms like Nvidia, Microsoft, Alphabet, and Meta.

Third, the rise of passive investing amplifies concentration. As these companies grow in size, more ETF flows automatically funnel back into them, reinforcing their dominance.

The result is a feedback loop:

Growth → Passive inflows → Higher index weight → More inflows.

This makes the Magnificent Seven not just market leaders—but market drivers.

Nvidia and Alphabet: Fundamentals Behind the Momentum

Nvidia: The Core Engine of AI Infrastructure

Nvidia’s latest earnings confirm its role as the backbone of global AI infrastructure. In its FY2026 Q3 results:

- Revenue: $57 billion (+62% YoY)

- Data center revenue: $51.2 billion (+66% YoY)

- Gross margin: ~74%

AI training and inference demand continues to outpace GPU supply. Cloud hyperscalers are locked into multi-year capex cycles to build capacity for AI workloads. Nvidia benefits from both scale and scarcity, supporting the view that its valuation—while elevated—is backed by unusually strong fundamentals.

Alphabet: Top Performer with a Reasonable Multiple

Alphabet leads the Magnificent Seven with over 60% YTD gains, driven by:

- A strong rebound in search and YouTube advertising

- Improved profitability in Google Cloud

- The integration of Gemini AI across search, ads, and cloud services

Despite this performance, Alphabet trades at a forward P/E in the low 30s, which many analysts consider reasonable given its cash generation, diversified revenue base, and expanding AI monetization channels.

Why Some Analysts Still Call Big Tech “Undervalued”

Several arguments support the view that Magnificent Seven stocks—at least the AI-aligned names—are not overpriced.

- Earnings growth is outpacing valuation expansion.

Morningstar and other firms highlight that companies such as Nvidia, Meta, Microsoft, and Alphabet continue to deliver earnings growth well above market averages. - AI is expanding the total addressable market (TAM).

AI is not a single product cycle; it is reshaping cloud workloads, enterprise software, consumer search, digital ads, and hardware. This widens the growth runway. - Winner-takes-most dynamics favor established players.

Training frontier models, deploying inference infrastructure, and scaling cloud platforms require capital and expertise that only a handful of companies possess. - Cash flow strength supports sustained buybacks.

Alphabet, Microsoft, and Meta all generate tens of billions in free cash flow annually—reducing downside valuation risk.

These points underpin Wall Street’s stance that the AI boom is backed by measurable fundamentals, not solely investor enthusiasm.

AI Bubble Concerns and Concentration Risk

Despite strong fundamentals, risks remain.

Morgan Stanley has flagged that the AI investment cycle may be entering a “late expansion phase,” where expectations run ahead of reality. JPMorgan similarly warns that 70%–90% of S&P 500 earnings and capex growth is now tied to AI-related stocks—a level of dependency that could amplify volatility if growth slows.

Because the Magnificent Seven represent such a large share of major indices, even a modest pullback in one or two names can ripple through the entire market. This creates a structural vulnerability for index-heavy investors.

In other words:

The long-term story is compelling, but concentration raises near-term risks.

Investment Strategies: A Smarter Way to Hold the Magnificent Seven

Instead of buying all seven stocks equally, investors may benefit from a split framework:

1) Separate the “AI Growth Core” from the rest

- AI Growth Core: Nvidia, Alphabet, Microsoft, Meta

- Mixed Exposure Group: Apple, Amazon, Tesla

Only the first group has clear, sustained visibility into multi-year AI revenue expansion.

2) Use index and sector ETFs to reduce concentration risk

Because S&P 500 ETFs already overweight the Magnificent Seven, investors seeking balance might include:

- Equal-weight S&P 500 ETFs

- Financials, healthcare, or industrials ETFs

- Global diversification to offset U.S. mega-cap exposure

3) Apply the “Core–Satellite” model

- Core: Broad market ETFs (VOO, VTI, QQQM)

- Satellite: Select Magnificent Seven names or AI/semiconductor ETFs

This provides upside participation without overreliance on a single theme.

The Magnificent Seven continues to define the U.S. equity market. Nvidia and Alphabet stand out as the clearest beneficiaries of the AI infrastructure cycle, and Wall Street sees meaningful upside left in these names.

Still, concentration risk is real. Not every Magnificent Seven stock shares the same growth outlook, and AI expectations could cool at any time.

A balanced approach—AI growth exposure plus thoughtful diversification—remains the most durable strategy for 2026 and beyond.

References

- Sparkline Capital. (2025). Surviving the AI Capex Boom.

- Morningstar. (2025). Tech Stocks With Rapid Profit Growth That Are Still Undervalued.

- Morgan Stanley. (2025). The Bull Market’s Seventh Inning.