AI-Driven U.S. Economy Bubble Risk: Sustainable Growth or Overheating from the 2025 AI Investment Boom?

The AI-driven U.S. economy shows powerful growth in 2025, but rising valuations raise bubble risk. Explore how AI investment reshaped America’s growth—and where correction signals may appear.

Key Takeaways

✔ The AI-driven U.S. economy now powers nearly half of GDP growth

✔ AI stock valuation analysis shows parallels to the dot-com bubble

✔ BoE and IMF warn of correction signals amid the AI investment boom

✔ The CRR model helps quantify the hype-to-reality gap

✔ Investors need diversification and careful monitoring of bubble risks

The AI Investment Boom: How It Reshaped U.S. Economic Growth

The AI-driven U.S. economy in 2025 is rewriting the rules of growth.

Stock indexes keep hitting records as the AI investment boom lifts both corporate profits and market sentiment.

According to the Financial Times, “America is now one big bet on AI.”

Roughly 40% of U.S. GDP growth is now linked to AI-based investment activity, from semiconductors and cloud computing to generative AI startups. (FT)

This AI-based economic growth has shifted the nation’s industrial base from manufacturing to high-tech infrastructure.

Yet this transformation carries a critical caveat — concentration risk. When growth relies too heavily on one innovation theme, the risk of a sudden correction grows exponentially.

Early Correction Signals: BoE and IMF Warn of an AI Bubble Risk

While optimism remains high, central banks and analysts are warning of potential overheating.

The Bank of England recently cautioned that the AI-driven U.S. economy could face a correction if market sentiment changes.

Its report noted that AI stock valuations resemble the peaks of the dot-com era — a classic warning sign of speculative excess. (Reuters)

The IMF added that excessive exposure to AI-based assets might distort global capital flows and threaten stability.

In contrast, Goldman Sachs maintains that the AI investment boom still rests on solid fundamentals — though valuation gaps are widening. (Axios)

For now, the market sits between two narratives: a historic productivity leap and an emerging bubble risk.

Both can coexist — but only one will define the next economic cycle.

AI Stock Valuation Analysis: Data Behind the Market Euphoria

The S&P 500 and Nasdaq are up 15–19% year-to-date, and nearly 80% of those gains stem from AI-linked companies.

This concentration illustrates just how much the AI investment boom dominates the broader market. (Reuters)

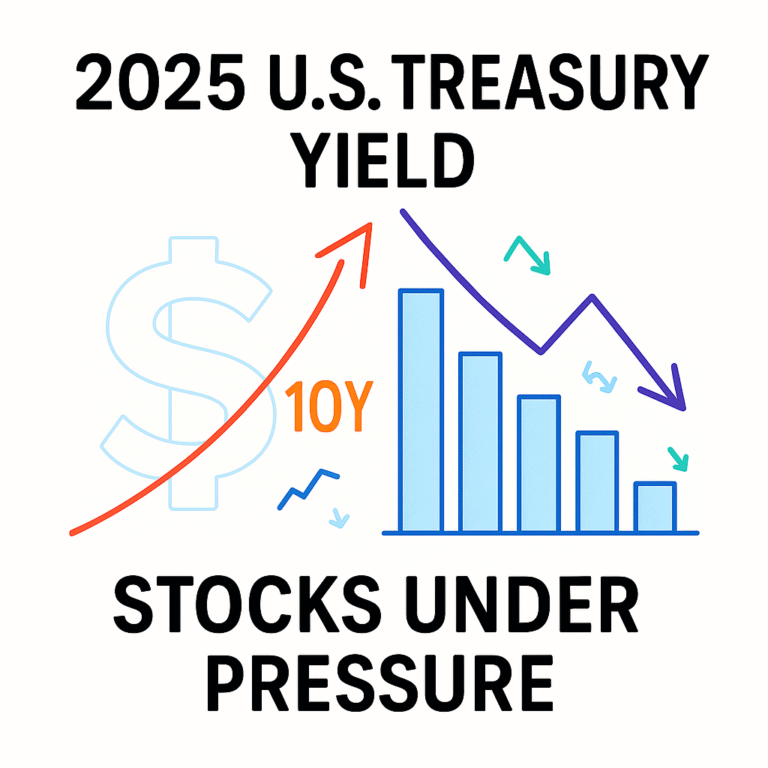

But valuation metrics suggest the rally may have run ahead of fundamentals.

AI stock valuation analysis shows that many top names trade at price-to-earnings ratios similar to 2000’s dot-com bubble.

The BoE report warns that even a mild shift in sentiment could cause an outsized correction.

Corporate filings echo that concern.

As of 2025, 43% of U.S. public firms reference “AI risk” in their SEC 10-K filings — up from just 4% in 2020. (arXiv)

That spike shows growing awareness of systemic exposure within the AI-driven U.S. economy bubble risk narrative.

AI Growth Drivers vs. Bubble Risk Factors

|

Category |

Growth Drivers |

Bubble Risks |

|---|---|---|

|

Capital Flows |

Massive inflows into Big Tech and AI startups |

Overconcentration in a few mega-cap names |

|

Innovation |

Productivity gains from AI automation |

Overstated commercialization timeline |

|

Policy Support |

U.S. government funding for AI R&D |

Potential regulatory tightening |

|

Valuation Metrics |

Partial earnings support for prices |

Excessive P/E ratios, CRR gap widening |

|

Risk Disclosure |

More AI-risk mentions in SEC reports |

Uneven transparency across sectors |

CRR Model: Measuring the Gap Between AI Hype and Real Performance

To measure the real sustainability of AI-based economic growth, researchers introduced the Capability Realization Rate (CRR) model.

It quantifies how much of a firm’s projected AI capability translates into real revenue. (arXiv)

In other words, CRR helps investors spot where AI-driven valuations are inflated.

A low CRR indicates hype exceeding execution, while a high CRR suggests strong implementation.

This AI stock valuation analysis tool can help investors differentiate sustainable innovation from speculative momentum — essential in managing AI-driven U.S. economy bubble risk.

Expert Opinions: Where the Line Between Growth and Bubble Gets Blurry

- Bank of England — “AI valuations resemble the 2000 dot-com peak; sentiment could reverse quickly.” (Reuters)

- Goldman Sachs — “We’re not in an AI bubble yet, but the rally is increasingly driven by expectations, not earnings.” (Axios)

- IMF — “AI concentration could fuel asset imbalances and global volatility.” (AP News)

- Academic Studies — “Firms with low CRR show the widest hype-to-value gap.” (arXiv)

These expert insights align on one key point:

The sustainability of the AI-driven U.S. economy depends on how fast real productivity catches up to market expectations.

Structural Fragility: When AI Concentration Becomes a Liability

The AI-driven U.S. economy faces an emerging concentration risk.

Just ten AI-heavy companies account for over 60% of S&P 500 gains — making the market unusually fragile.

Meanwhile, the AI investment boom strains physical infrastructure.

Demand for chips, cloud data centers, and electricity is surging.

Le Monde warns that AI’s “appetite for power” could even trigger electricity shortages in the U.S. (Le Monde)

Regulation is another looming factor.

The SEC plans to enforce stricter AI-risk disclosure rules, requiring transparency on data models, liability, and governance. (arXiv)

Such developments could temper speculative momentum — or expose weaknesses in overstretched firms.

What Lies Ahead: Growth Path or Correction Phase?

The next phase of AI-based economic growth will hinge on five key factors:

- Earnings verification: Can AI leaders sustain revenue growth?

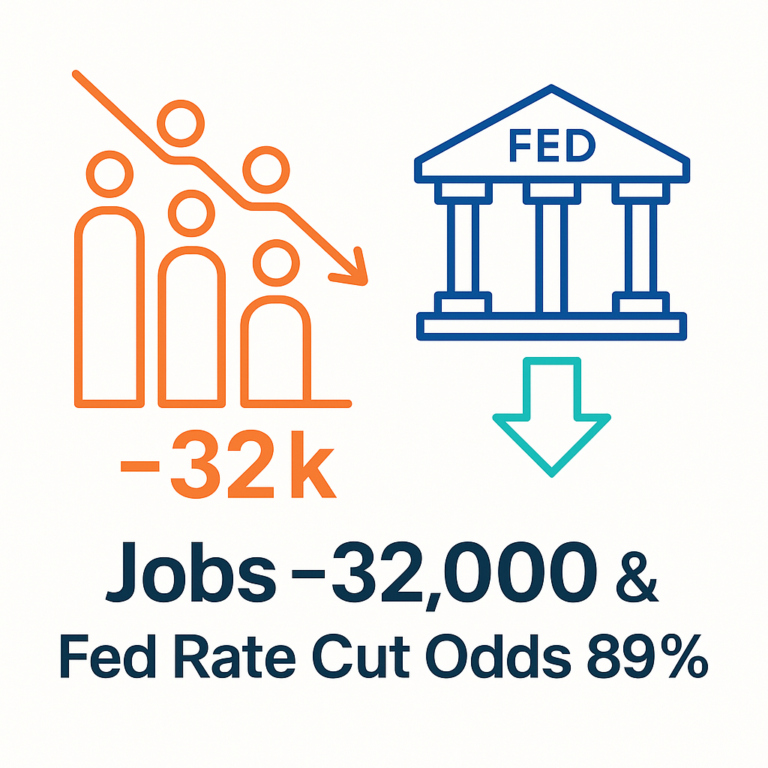

- Monetary policy: Will delayed Fed rate cuts pressure valuations?

- Disclosure standards: How aggressively will the SEC enforce transparency?

- Tech evolution: Open-source competition may erode margins faster than expected.

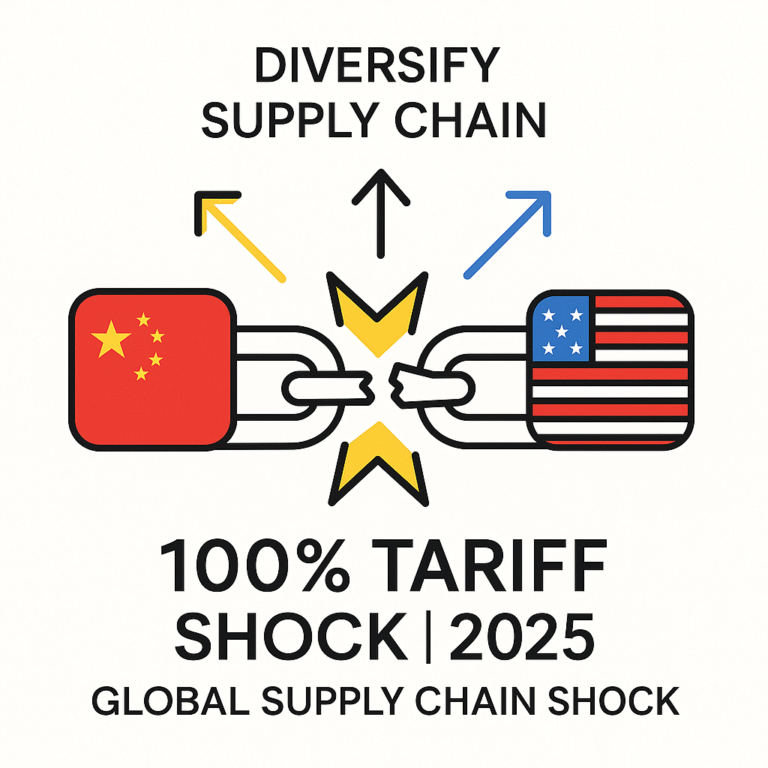

- External shocks: Energy prices, geopolitics, and supply chains remain wild cards.

Ultimately, 2025’s defining question for investors is:

Can the AI-driven U.S. economy turn hype into sustainable value before correction signals turn into a market slide?

AI innovation is transforming the U.S. economy faster than any previous technology wave.

But as AI investments expand, the risk of overvaluation grows just as fast.

For investors, balancing exposure to AI’s upside while hedging against the bubble risk is crucial.

Tracking CRR metrics, diversification across sectors, and regulatory trends will be key to staying ahead of the next correction.

References

- America is now one big bet on AI — FT

- Bank of England warns of AI bubble risk — Reuters

- Goldman Sachs: We’re not in an AI bubble (yet) — Axios

- High stock valuations spark investor worries — Reuters

- AI risk disclosure trend report — arXiv

- CRR Model & AI valuation gap study — arXiv

- AI electricity demand warning — Le Monde

- IMF on global AI asset imbalance — AP News