Fed Rate Cut in October 2025: Why Powell’s “No More Cuts” Warning Could Reshape Markets

The Fed cut rates to 3.75–4.00 % but hinted there may be no more cuts this year. Here’s what Powell’s warning means for stocks, bonds, and investor strategy.

Key Takeaways

✔ The Fed lowered the benchmark rate by 0.25 points to 3.75–4.00 %.

✔ Powell said a December cut is “not guaranteed,” signaling the easing cycle may be near its end.

✔ The vote was 10-to-2, showing internal disagreement over how far easing should go.

✔ The ongoing U.S. government shutdown is creating a data gap, making policy decisions more uncertain.

✔ Markets are recalibrating expectations across bonds, equities, and currencies.

The Fed Cuts Again — But Signals It May Be Done

On October 29, 2025, the Federal Reserve trimmed its benchmark rate by 25 basis points to a range of 3.75–4.00 %.

At first glance, that looked like a straightforward “insurance cut” to cushion slowing growth.

But Chair Jerome Powell’s message was anything but dovish. He said explicitly that “another cut in December is not certain.”

That single sentence shifted market psychology: U.S. stocks pared gains, bond yields rebounded, and the dollar bounced back from its initial drop.

In other words, this was not a simple continuation of an easing cycle.

It was a turning point — a signal that the Fed is prioritizing caution and data integrity over momentum in monetary policy.

Why the October Rate Cut Happened: Managing Risk in a Data Vacuum

The Fed’s move reflects a balancing act between slowing demand and lingering inflation.

Recent reports show weaker job creation and softer retail spending, while headline inflation continues to cool.

However, the situation is complicated by the ongoing government shutdown, which has suspended key economic releases such as the CPI and employment data.

As Powell put it, “We’re driving through fog — we’ll gather every scrap of data we can.”

The policy vote itself highlighted internal division: 10 members favored a quarter-point cut, one wanted 50 bps, and one dissented entirely.

This rare split underscores the Fed’s uncertainty about whether the economy truly needs further easing.

Ultimately, October’s cut was less about stimulating growth and more about risk management under incomplete information — a “precautionary” rather than a “proactive” move.

Market Reaction: Expected Move, Unexpected Message

Markets fully anticipated a 25-basis-point cut, but not the hawkish tone that followed.

The S&P 500 and Nasdaq jumped nearly 1 % immediately after the announcement, only to give up half those gains once Powell spoke.

Two-year Treasury yields briefly fell, then rebounded as traders priced out the odds of another cut.

The U.S. dollar mirrored that pattern — initial weakness followed by a quick recovery.

The reaction revealed a shift in narrative: investors now see this as the last rate cut of 2025, not the start of a series.

In that context, timing the “end of easing” has become more relevant than predicting how far it goes.

Economic Signals: Soft Spending, Weak Confidence, Data Fog

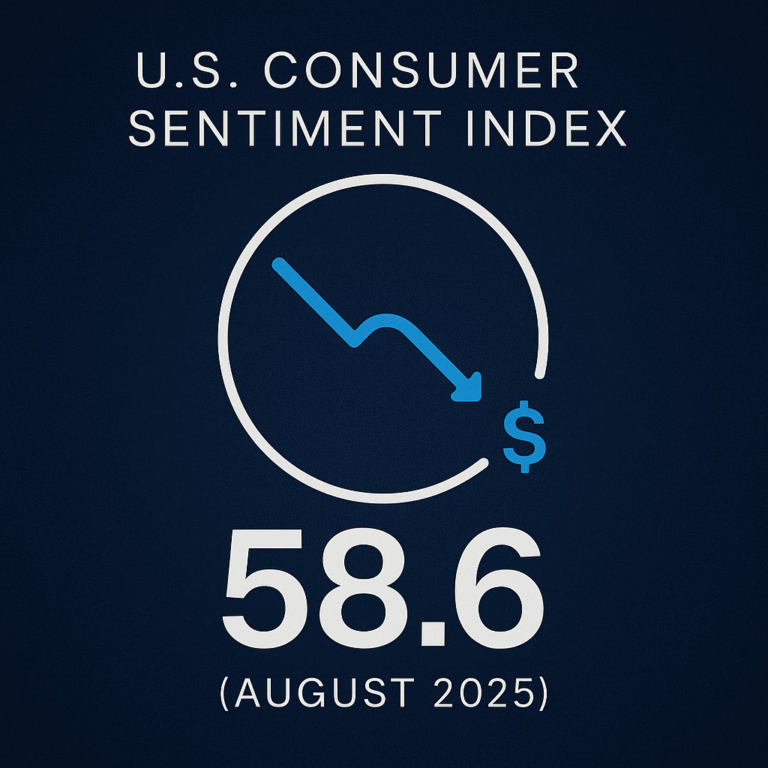

The latest Conference Board Consumer Confidence Index fell to a six-month low.

Households earning under $75,000 reported growing concern about job security — a warning sign for future spending.

Meanwhile, with the shutdown delaying official inflation and labor reports, the Fed is essentially steering without instruments.

The IMF recently noted that while the U.S. growth outlook remains better than earlier this year, consumer-driven momentum could fade quickly if confidence continues to erode.

This mixture of slowing demand and limited visibility explains why the Fed opted for a small cut — to buy time — but avoided promising more.

How the “Last Cut” Narrative Is Rippling Through Assets

Bond Markets

Short-term yields fell briefly but then reversed, steepening the yield curve.

Investors are shifting toward barbell strategies — holding both short-duration and core intermediate bonds — to balance yield capture and volatility risk.

Stock Markets

Lower rates typically boost growth stocks, but the “no more cuts” message caps valuation upside.

As a result, funds are rotating into dividend-paying and cash-flow-strong companies that can perform even without further easing.

Currencies

The dollar remains resilient.

Hawkish Fed language offset rate-cut expectations, keeping USD index levels stable despite earlier bets on a weaker greenback.

In short, the October decision injected new uncertainty into asset allocation.

Investors are now weighing “how long rates stay low” rather than expecting a continuous decline.

Housing and Credit Markets: Relief Will Be Gradual

A lower policy rate typically filters into mortgage and auto loan costs, but this time the transmission may be slow.

Banks are cautious about passing on the full cut while data gaps persist and inflation risks linger.

For borrowers with mid- to low-credit scores, lending standards may remain tight.

That means mortgage rates could edge down — but not enough to spark a broad housing rebound.

Real estate will likely see a “stabilization” rather than a renewed boom.

Scenario Table: What Could Come Next

|

Scenario |

Policy Trigger |

Bonds |

Stocks |

Dollar |

Portfolio Implication |

|---|---|---|---|---|---|

|

A. December Pause |

Prolonged shutdown, renewed inflation |

Steeper yield curve |

Growth volatility, value outperforms |

USD strengthens |

Hold intermediate duration, add cash buffer |

|

B. Another Cut in December |

Labor weakness, deeper confidence drop |

Duration outperforms |

Defensive sectors lead |

Dollar softens |

Increase bond allocation, trim risk assets |

|

C. Gradual Easing Resumes 2026 |

Data restored, inflation stays tame |

Core bonds benefit |

Quality growth rebounds |

Mixed |

Balanced portfolio – AI + dividend blend |

The path will depend heavily on the speed of data normalization once the shutdown ends.

Investor Checklist: Staying Rational in a Policy Fog

- Re-evaluate duration. Favor intermediate maturities over pure long-bonds.

- Balance growth and income. Pair tech exposure with stable dividend names.

- Manage currency risk. Blend hedged and unhedged USD assets.

- Avoid over-leveraging. Don’t bet everything on further cuts.

- Track the calendar. The December FOMC meeting and shutdown resolution will define the next phase.

October’s Fed decision wasn’t just another step in an easing cycle — it may have been the pivot point.

By signaling that more cuts aren’t guaranteed, Powell effectively told markets that monetary policy has entered its cautious phase.

For investors, that means shifting from rate-cut optimism to cash-flow discipline and risk-balanced portfolio design.

In a data-fog environment, patience and selectivity will outperform prediction.

References

- Reuters – Fed lowers rates… Powell says December cut not assured

- Reuters – Instant View: Fed delivers expected rate cut amid shutdown data limits

- Reuters – U.S. consumer confidence slips to six-month low; worries over job availability rising

- Reuters – Fed poised to cut rates this week with more easing likely on tap

- Investopedia – Dow Jones Today: Stocks Slip After Fed Rate Cut; Powell Hints at Pause

- LiveMint – US Fed Meeting LIVE Updates: Key interest rate cut to 3.75–4.00%

- IMF – World Economic Outlook, October 2025: Balancing Growth and Inflation