How the 2025 US AI Investment Cycle and Productivity Shock Could Shape Stock Portfolios

Explore how the 2025 US AI investment cycle and potential AI productivity shock may affect stock portfolios and investor strategies.

Key Takeaways

✔ The 2025 US AI investment cycle is fueled by $109.1B in spending, 12x higher than China’s.

✔ Early adoption risks an AI productivity shock where output falls before gains materialize.

✔ BlackRock sees AI as a top driver for stock performance in 2H 2025.

✔ Best portfolio strategy: phase into 2025 AI beneficiary stocks starting with hardware, then platforms, then automation.

✔ Key risks: overvaluation, delayed productivity, regulation, and competition.

The 2025 US AI investment cycle is reshaping markets. In 2024, US private AI investment reached $109.1 billion, far ahead of China. This massive surge signals how central AI has become for corporations.

But investors face a paradox: AI investments can trigger a short-term productivity shock before delivering long-term efficiency. MIT Sloan found firms where AI adoption initially slowed output. For stock investors, this gap between expectation and reality is critical.

So how should investors adjust their portfolios to capture AI-driven growth while managing risks of an AI productivity delay? Let’s break it down.

The Year-by-Year Shift in the 2025 US AI Investment Cycle

|

Year |

US AI Investment / Key Feature |

Turning Point |

|---|---|---|

|

2023 |

Generative AI hype drove early surge |

Infrastructure and model training focus |

|

2024 |

$109.1B invested, US dominance |

Intense global competition |

|

2025 (est.) |

Institutional flows expand |

Datacenter build-out, shift to applications |

The 2025 US AI investment outlook is best described as a transition year. Capital that once concentrated on GPUs and semiconductors is now powering data centers and cloud infrastructure. The next wave points to applications and automation, creating opportunities for 2025 AI beneficiary stocks.

Morgan Stanley estimates AI could deliver $40 trillion in efficiency gains worldwide, while Vanguard argues that the payoff will be slower. For investors, this cycle blends opportunity with uncertainty.

The AI Productivity Shock: Evidence Behind the “Paradox”

Adopting AI doesn’t guarantee immediate efficiency. MIT Sloan research shows firms experiencing a productivity shock after initial adoption. In one RCT, developers using AI coding tools took 19% longer to complete tasks.

Yet long-term data is more positive. Stanford’s AI Index suggests AI can close skill gaps and raise efficiency across industries. JP Morgan projects data center spending may lift US GDP by 10–20 bps in 2025–26.

The key for investors: AI productivity delay and stock investing are linked. Gains may take time, but positioning early can secure upside once the cycle matures.

Expert Views on AI Investment and Productivity

“AI has the potential to create $40 trillion in efficiency.” — Morgan Stanley

“AI themes may support short-term stock returns while fueling long-term productivity growth.” — BlackRock

“Early adoption can cause temporary productivity losses.” — MIT Sloan

Across institutions, the message is consistent: the AI productivity shock stock impact is real, but so are the opportunities once productivity accelerates.

How AI Expansion Impacts Industries, Policy, and Portfolio Strategy

- Industries benefiting from the 2025 US AI investment cycle:

- Semiconductors & GPUs: direct winners from AI training demand.

- Cloud & AI platforms: positioned for recurring revenue streams.

- Automation & robotics: expected to scale with real-world adoption.

- Policy & regulation:

The US government supports AI research and infrastructure, but regulatory tightening on privacy and transparency could reshape the AI investment outlook portfolio strategy. - Investor strategies:

- Rotate into 2025 AI beneficiary stocks step by step—hardware → platforms → applications.

- Combine defensive sectors with AI exposure to manage volatility.

- Avoid overheated valuations that could collapse during corrections.

What’s Next: Timeline and Risks in the AI Investment Outlook

The 2025 US AI investment cycle will accelerate in 2H 2025, with data center build-outs dominating. From 2026–27, AI applications are expected to scale, unlocking revenue.

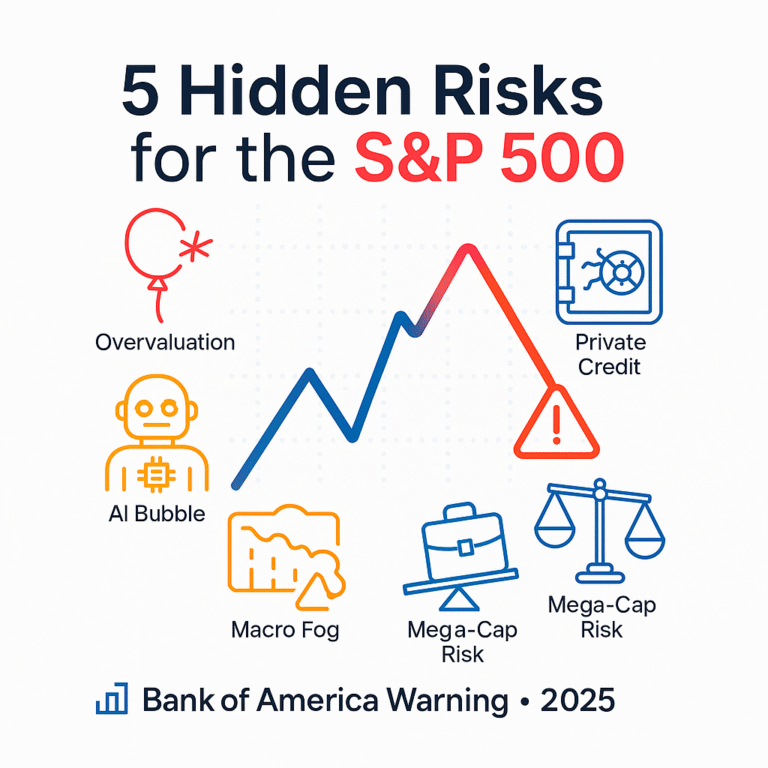

Risks investors must monitor:

- Overvaluation of AI stocks.

- Delayed productivity payoff, creating frustration for short-term traders.

- Regulatory tightening on AI ethics and safety.

- Competition, as more players chase the same growth opportunities.

The 2025 US AI investment cycle brings both opportunity and turbulence. Investors must recognize the potential for an AI productivity shock stock impact, while also positioning for long-term growth from 2025 AI beneficiary stocks.

A thoughtful AI investment outlook portfolio strategy should phase exposure, manage risks, and anticipate a delayed productivity payoff.