Is Europe Cornered by the US–EU 15% Tariff Deal?

The U.S. and EU agreed to a 15% tariff to avert a trade war, but Europe remains at a disadvantage. Explore the deal’s context, data on trade shares, expert analysis and future risks in this comprehensive review of the 2025 transatlantic trade accord.

Key Takeaways

Europe’s Global Weight and the Specter of a Trade War

In global trade, the European Union remains an economic giant. Eurostat data show that the EU accounted for 13.2% of world exports and 14.8% of imports in 2022. Yet the bloc’s relative clout is waning. Purchasing‑power‑parity estimates from the International Comparison Program indicate that the EU’s GDP represented just 15.2% of the world economy in 2021, with Germany, France, Italy, Spain and Poland together responsible for about 10%. On the other side of the Atlantic, U.S. Census Bureau figures show that U.S. trade with the EU resulted in a $235.9 billion goods deficit in 2024. Against this backdrop, Washington pointed to trade imbalances and domestic industrial policy to justify potential tariff hikes, putting Europe under intense pressure.

From a 30% Threat to a 15% Deal

Early in July 2025, the Trump administration threatened tariffs of up to 30% on EU imports, ratcheting up tensions after months of stalled negotiations. The EU prepared retaliatory duties on €93 billion worth of U.S. products but hesitated to deploy them because of its reliance on American digital and defence industries. On 27 July, after a one‑hour meeting at Donald Trump’s golf course in Turnberry, Scotland, the two sides reached a compromise: a 15% tariff on most goods. Trump hailed it as “the biggest deal ever,” touting plans for the EU to invest about $600 billion in the United States and to boost energy and defence purchases. European Commission President Ursula von der Leyen called the 15% rate “the best we could get,” noting that it applies to automobiles, pharmaceuticals and semiconductors.

Europe’s Trade Structure and the U.S. Deficit

Europe’s trade numbers reveal a mixed picture. In 2022, the EU’s share of global goods exports stood at 13.2% and imports at 14.8%, both down from a decade earlier. Eurostat reports that in 2023 the EU exported €4.00 trillion worth of goods and services while importing €3.61 trillion, producing a €389 billion surplus. Purchasing‑power‑parity data show that the EU’s GDP represented 15.2% of world output in 2021, with five member states accounting for about 10.1%. In contrast, the U.S. recorded a goods‑trade deficit of $235.9 billion with the EU in 2024—a figure repeatedly cited by the White House as justification for tariffs. Taken together, the numbers suggest that although the EU remains a major trading power, its share of global commerce and output is declining relative to the United States and China.

Lack of Details and Europe’s Weakness

Reactions to the deal have been cautious. Carsten Nickel, research director at the consultancy Teneo, warned that the arrangement is “merely a high‑level, political agreement” and said that, like the parallel deal with Japan, it leaves room for diverging interpretations and future conflicts. Bernd Lange, a German Social Democrat who chairs the European Parliament’s trade committee, criticised the 15% tariff as unbalanced and argued that the EU’s hefty investment commitment would come at the bloc’s own expense. Christian L. Rus, president of the German trade federation (BGA), called the outcome a wake‑up call, urging Europe to reduce its dependence on the United States and to pursue new trade agreements. These comments underscore the perception that Brussels entered the talks with limited leverage and accepted a compromise out of necessity.

Industrial and Policy Effects

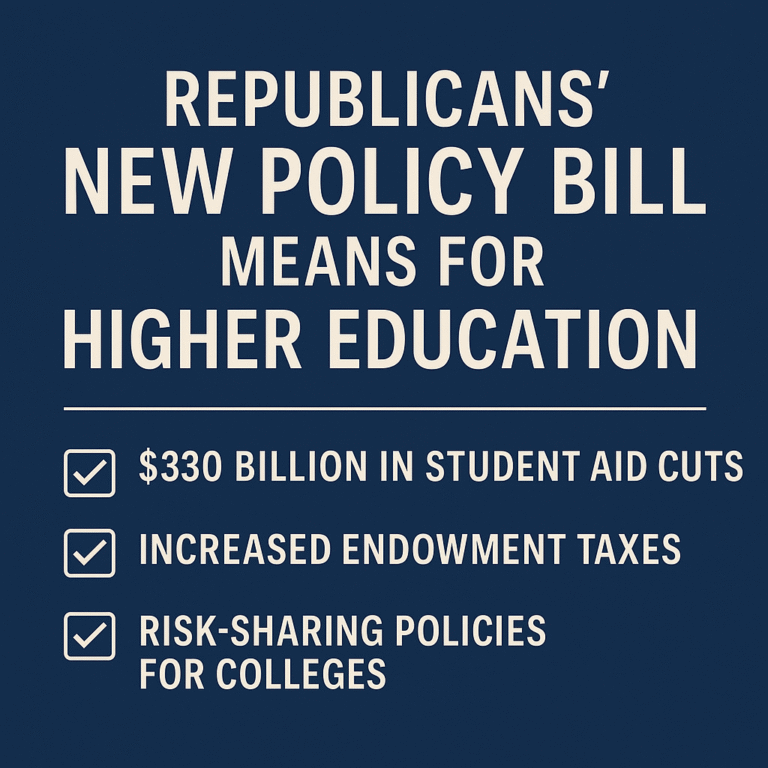

A 15% tariff raises immediate costs for Europe’s export sectors. Industries such as automotive, aerospace, pharmaceuticals and semiconductors rely heavily on the American market; higher duties could erode profitability and competitiveness. The European Central Bank estimates that sustained trade tensions could cap EU growth at 0.5–0.9%, below the more than 1% baseline forecast under a zero‑tariff scenario. Meanwhile, Europe’s capacity to retaliate is constrained by its dependence on U.S. digital services and defence technology. The United States retains a 50% tariff on steel and aluminium and holds the option to raise tariffs again if the EU fails to deliver its investment promises. While the macroeconomic impact is uncertain, some European firms are already contemplating shifting production to North America to maintain market access.

Easing Tensions and New Negotiations

For now, the agreement removes the immediate risk of a transatlantic trade war, but unresolved issues remain. The text commits both sides to discuss expanding the list of exempt goods such as aircraft components, certain chemicals and raw materials. U.S. officials emphasised that tariff rates could rise again if European investment pledges are not met. Brussels plans to fulfil its $600 billion investment and $750 billion in U.S. energy and defence purchases, yet many EU capitals are simultaneously exploring deals with Asian and Latin American partners and seeking to strengthen the single market. Future U.S. elections and European political cycles will influence tariff policy, and the evolving dynamics of supply chains and technology rivalry will determine whether the US–EU 15% tariff deal becomes a stepping stone to deeper cooperation or a precursor to renewed tension.

An Unsteady Deal Requires Vigilance

The US–EU 15% tariff deal provides short‑term relief by averting a trade war, but its lack of detailed provisions, the challenge of fulfilling massive investment pledges and the potential for further tariff increases make it far from a settled matter. Even though the EU still accounts for roughly 16.6% of global trade, its slow growth and growing reliance on the U.S. erode its bargaining power.