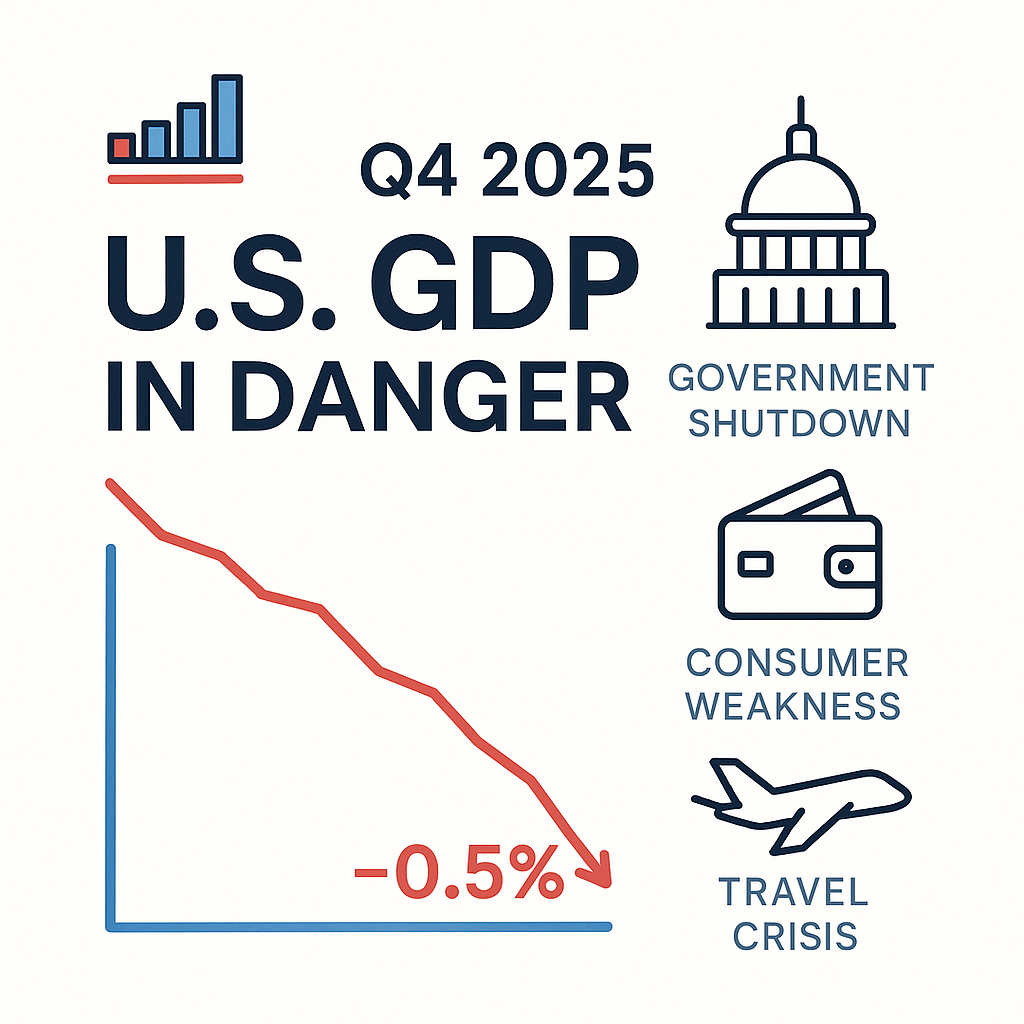

Q4 2025 U.S. GDP Outlook: Could the Government Shutdown, Slumping Consumer Demand & Flight Disruptions Push Growth into the Red?

With the U.S. federal government shutdown, weak consumer demand and major airline disruptions coinciding, the risk of negative GDP growth in Q4 2025 is rising. This article examines the latest data and implications.

Key Takeaways

✔ The White House officially warned that a prolonged shutdown could push Q4 2025 U.S. GDP into negative territory.

✔ University of Michigan consumer sentiment plunged to 50.3 in early November – a post-pandemic low.

✔ Airline cancellations and air traffic controller shortages are causing a direct hit to services and GDP.

✔ Estimates from the CBO suggest GDP losses of $70–140 billion or –0.1% to –0.2% points per week of shutdown.

✔ A data blackout from delayed official reporting is amplifying market uncertainty and volatility.

The Shadow Over U.S. Q4 2025 Growth

On October 1, 2025, the U.S. federal government entered a shutdown after Congress failed to pass appropriations. This shutdown quickly turned from a political stalemate into a real-time economic drag.

The White House’s economic council warned that if the shutdown drags on, Q4 growth could turn negative. Consumer demand is faltering, public spending is frozen, and travel-related service consumption is collapsing.

What was once an abstract risk is now a tangible drag on the 2025 Q4 U.S. economy.

How the Shutdown Triggered a Demand Shock for Q4 2025

The government shutdown is no longer just a budget story—it’s a major supply-and-demand disruption.

Over ~900,000 federal employees have been furloughed or are working without pay, sharply curtailing consumer spending and ripple-effects in their communities.

Federal procurement and contracting have come to a halt, hitting small businesses and vendors that supply the government.

Past shutdowns, such as in 2018-19, cost over $11 billion; in this service-driven economy, the impact this time may be far greater.

Slumping Consumer Sentiment Signals Cooling U.S. Economy

Consumer spending accounts for roughly 70% of U.S. GDP—so when sentiment sinks, the risk rises.

The University of Michigan’s Consumer Sentiment Index registered 50.3 in November, its weakest reading since immediately after the pandemic.

This plunge reflects mounting financial stress among federal workers, younger households, and lower-income segments.

Reduced willingness to buy big-ticket items, travel, or dine out weakens the service economy—an engine of U.S. growth.

In other words: weak sentiment → less spending → slower GDP growth.

Projected Q4 2025 GDP Decline: Comparing Institutional Estimates

|

Source |

Estimated Output Loss |

Growth Rate Impact (Annualized) |

Key Assumption |

|---|---|---|---|

|

Congressional Budget Office (CBO) |

$70 billion–$140 billion |

–0.1% to –0.2% points per week |

Shutdown-weeks × 0.1%p |

|

White House Economic Council |

> $150 billion |

–0.3% to –0.5% points |

Extended shutdown + demand collapse |

|

EY-Parthenon |

~$100 billion |

–0.15% points |

Service sector drag in a long shutdown |

The common thread: each additional week of shutdown subtracts roughly –0.1% to –0.2% points from growth. If Q4 spans 8–10 weeks under these conditions, annualized growth could be cut by 0.5% or more, or even slip into negative territory if consumer/travel weakness deepens.

Direct Impact of Airline & Travel Disruptions on GDP

The services sector—especially travel, hospitality, and air transport—is bearing the brunt of this demand shock.

As of early November, U.S. airports are reporting 30%+ cancellation or delay rates due to air traffic controller absences tied to the shutdown.

Declining travel hurts hotels, restaurants, rental cars, attractions and more—reducing consumption and GDP contribution.

Because services dominate U.S. GDP, these disruptions are not marginal—they strike one of the largest growth engines.

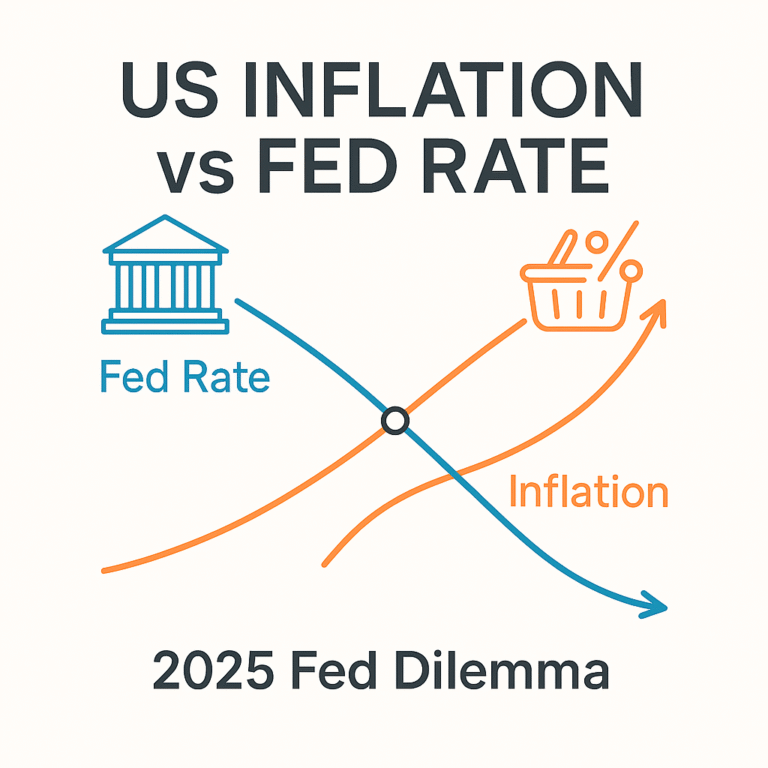

Data Blackout & Policy Confusion: Driving Blind in Q4 2025

The shutdown has halted or delayed key economic data—unemployment reports, CPI releases, retail sales are all impacted.

Without timely data, policy-makers and markets lose their compass: is the economy weakening? Are jobs collapsing? No reliable answer.

Analysts describe the situation as “blind-driving” through the policy cycle. The result: volatility, mis-priced risk, and delayed decision-making.

When the data lamp goes dark, the shock absorber fails—and the economy becomes more sensitive to surprises.

Expert Commentary: The Warning Signals Are Loud

Kevin Hassett, White House economic adviser, commented: “If the shutdown continues through late November, GDP growth could turn negative.”

Treasury Secretary Scott Bessent warned the shutdown could deal “a hit to working America” and reduce GDP significantly.

JPMorgan’s analysis highlights that this shutdown differs from past ones: large number of federal workers, tight consumer sector, and travel bottlenecks combine to deepen the drag.

In short: the consensus is clear—longer shutdown = deeper growth hit.

Sectoral Effects: Who Wins, Who Loses in a Q4 2025 Downturn

Losers: Retailers, airlines, hotels, restaurants and luxury goods—all heavily dependent on strong consumer spending or travel flows.

Winners (or less exposed): Healthcare, utilities, consumer staples—these “defensive” sectors tend to hold up better in a slowdown.

In fixed income, lower growth expectations push long-term yields down, while equities face higher risk premia and greater drawdowns.

For portfolio strategy: shift into cash-flow-generative stocks + defensive ETFs while maintaining optional upside exposure in travel/consumer when normalization happens.

What’s Ahead? Scenarios and Investor Checklist

Scenario A – Early Resolution: Shutdown ends in mid-November. Some “pent-up” spending kicks in. GDP loss partially reversed; growth stays positive (0.3–1.0%).

Scenario B – Prolonged Disruption: Shutdown extends into December. GDP could contract by –0.5% or more in Q4. Travel and consumer weakness deepen.

Key triggers to watch:

- Congressional votes on funding bills

- University of Michigan consumer sentiment updates

- Weekly air traffic statistics and hotel occupancy data

- Data releases for retail sales and employment once restored

For investors: increase allocation to defensive assets now, while considering tactical exposure to rebound sectors once normalization begins.

The risk for Q4 2025 in the U.S. is not just negative GDP growth—it is the uncertainty and disruption hitting multiple fronts simultaneously. A government shutdown, collapsing consumer confidence, and travel breakdowns wire a highly volatile growth equation. In this environment, informed, agile positioning matters more than ever.

References

- Federal shutdown could cost U.S. economy up to $14 billion. Reuters, October 29, 2025. Reuters

- Impact of U.S. government shutdown far worse than expected, White House adviser says. Reuters, November 7, 2025. Reuters

- Economic impacts of the federal government shutdown on local communities. NLC, November 7, 2025. National League of Cities

- Record shutdown leaves mark on the economy. EY, October 2025. EY

- US to lose $15 B in GDP each week of a shutdown, White House memo says. Politico, October 1, 2025. Politico