U.S. Bank Earnings Q3 2025: How Strong Profits Boosted the S&P 500 and What It Means for Investors

Major U.S. banks’ Q3 2025 earnings beat expectations, sending the S&P 500 higher. Discover the key drivers behind this rally and the best investment strategies for the months ahead.

Key Takeaways

✔ Strong Q3 2025 bank earnings drove a rally in U.S. financial stocks, lifting the S&P 500.

✔ Investment-banking fee growth and higher net interest income were the biggest profit drivers.

✔ Deal-making and consumer spending showed resilience in the U.S. economy.

✔ Investors should balance optimism with caution as interest-rate and credit risks persist.

How Q3 2025 Bank Earnings Shaped the Market

The U.S. bank earnings Q3 2025 market impact was immediate.

When Wall Street’s biggest banks—JPMorgan Chase, Goldman Sachs, and Bank of America—posted profits that beat expectations, the S&P 500 climbed to multi-month highs.

According to Reuters, revived M&A activity and improved trading income reignited optimism that the U.S. economy is stabilizing.

This article explains how these Q3 2025 bank profits boosted the S&P 500 and outlines an investment strategy after the bank earnings rally—from market sentiment to risk management.

Why U.S. Bank Earnings in Q3 2025 Lifted the S&P 500

Bank earnings act as an economic barometer.

In Q3 2025, U.S. banks benefited from a rebound in corporate deal-making, stronger loan demand, and cost discipline.

Interactive Brokers noted that this “deal-flow comeback is restoring confidence across capital markets.”

For investors, these positive surprises validated the view that financial sector earnings momentum 2025 could extend into year-end—fueling both financial-ETF inflows and sector rotation out of defensives.

By the Numbers: Q3 2025 Earnings Comparison

|

Bank |

IB Fee Growth |

Net Interest Income |

Net Profit Trend |

Highlights |

|---|---|---|---|---|

|

Goldman Sachs |

+42% (Reuters) |

— |

Beat estimates |

M&A and spin-offs drove revenue |

|

JPMorgan Chase |

+16% (Reuters) |

Trading +30% YoY |

Total revenue +9% |

Diversified earnings mix |

|

Wells Fargo |

+25% (Reuters) |

Higher after asset-cap lift |

Net income +18% |

Regulatory relief tailwind |

|

Bank of America |

+43% (WSJ) |

Record high |

Net income +23% |

Consumer strength and loan growth |

These data confirm a clear trend: investment-banking revenue rebounded while lending margins held firm.

That mix explains the bank profits boost S&P 500 index performance in Q3 2025.

Expert Insights and Market Signals

Goldman Sachs executives said “deal-making is back.”

JPMorgan’s CEO Jamie Dimon highlighted resilient consumer spending and steady credit quality.

Wells Fargo credited its asset-cap removal for profit expansion.

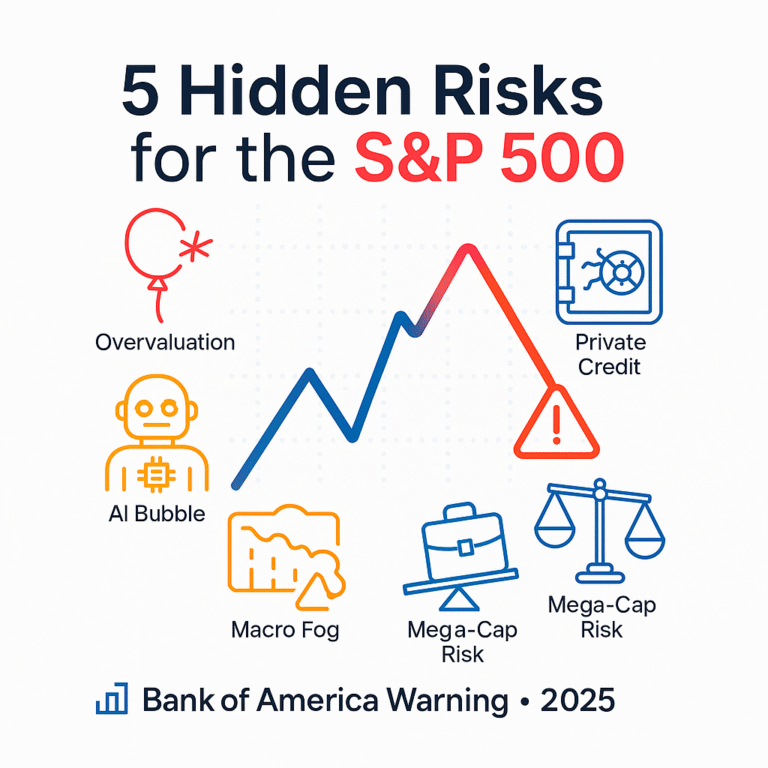

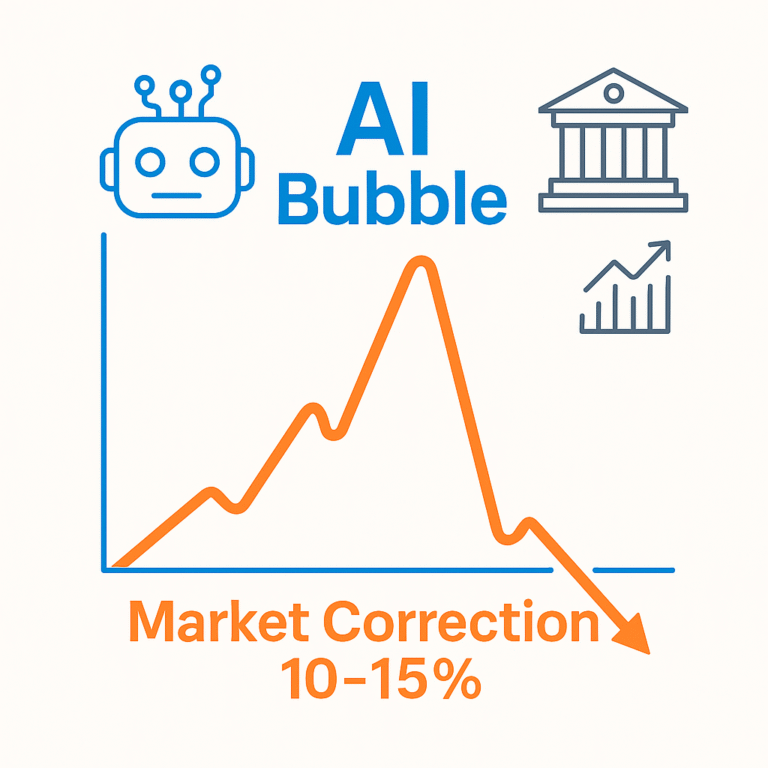

At the same time, Financial Times warned that banks see “bubble risks” if rates fall too fast or credit tightens again.

The bottom line:

- Deal-flow recovery is an early indicator of broader economic stability.

- Diversified revenue buffers banks against rate volatility.

- Long-term investors should watch for policy and credit headwinds before adding exposure.

Broader Market and Policy Implications

Financial Stocks Lead Again

The U.S. bank earnings Q3 2025 market impact has been evident in ETF flows and index weights.

The S&P Financials index outperformed as bank profits lifted overall market momentum.

Capital Markets and Corporate Investment

Stronger investment-banking fees mean corporations are once again raising capital and pursuing M&A.

That revival supports growth in AI, semiconductors, and clean energy — sectors likely to benefit from reopened liquidity channels.

Policy and Regulatory Risks

Wells Fargo’s profit jump after its asset cap was lifted (Reuters) shows how regulation still shapes bank profitability.

Future Fed rate decisions and Basel III capital rules could determine whether the financial sector outlook 2025 remains bullish.

Next Steps for Investors — Building a Post-Earnings Strategy

- Watch Q4 Guidance. Even after strong Q3 reports, banks may signal caution for year-end.

- Track Interest-Rate Effects. Potential Fed rate cuts could squeeze net interest margins.

- Monitor Credit Trends. Rising delinquencies or loan-loss provisions are early warning signs.

- Diversify Exposure. Consider financial ETFs like XLF or KBE for balanced risk control.

- Stay Level-Headed. With optimism priced in, “sell-the-news” pullbacks remain possible.

This disciplined approach helps align any investment strategy after the bank earnings rally with realistic market conditions.

The Q3 2025 U.S. bank earnings season proved that financial institutions still anchor market momentum.

Strong profits from investment banking, trading, and lending gave the S&P 500 its latest boost.

But sustainability depends on how banks adapt to rate cycles and regulatory pressures.

For investors, staying agile — with data-driven allocation and realistic expectations — will be key through the next quarter.

References

- Reuters: U.S. banks reap bigger profits as deals rebound in Q3 2025

- Reuters: Goldman Sachs profit jumps as deal-making returns

- Reuters: JPMorgan profit rises amid investment-banking boom

- Reuters: Wells Fargo profit rises as asset cap lifted

- WSJ: Bank of America reports profit, revenue above forecasts

- FT: Banks warn of bubble risks despite bumper profits