Walmart’s Move From NYSE to Nasdaq: Is the Retail Giant Becoming a “Tech-Powered Retail Company”?

Walmart will move from NYSE to Nasdaq in December 2025. This shift highlights its AI, automation, and e-commerce strategy. Here’s what it means for investors.

Key Takeaways

✔ Walmart leaves the NYSE after 53 years and begins trading on Nasdaq on December 9, 2025.

✔ Q3 2025 results showed 5.8% revenue growth, 33% profit growth, and 27–28% e-commerce growth.

✔ Management emphasized a “people-led, tech-powered” business strategy.

✔ The move could open the door to Nasdaq-100 inclusion and generate ETF-driven inflows.

✔ Walmart is evolving from a defensive consumer staple into a hybrid value-plus-growth tech-enabled retailer.

Walmart Inc. (WMT) is making one of its most symbolic moves in decades. After more than half a century on the New York Stock Exchange, the company will shift its primary listing to the Nasdaq Stock Market on December 9, 2025.

The timing is notable. Walmart reported strong Q3 2025 results—5.8% revenue growth, 33% profit growth, and nearly 30% e-commerce expansion. The numbers highlight a broader transformation: Walmart is shifting from a traditional brick-and-mortar retail model to a data-driven, AI-enhanced, automation-supported retail ecosystem.

This article explains why Walmart is moving to Nasdaq, how its digital strategy is reshaping the business, and what these changes mean for long-term investors.

Why Walmart Is Leaving the NYSE After 53 Years: The Real Drivers Behind the Move

Walmart first listed on the NYSE in 1972. For decades, it symbolized American retail and the broader consumer staples sector. The decision to move to the Nasdaq therefore carries significant strategic weight.

Management stated that the shift aligns with Walmart’s long-term vision of becoming a “people-led, tech-powered” company. Over the past several years, Walmart has invested heavily in AI systems, automated supply chains, digital store operations, and data-driven pricing.

Competitive dynamics also play a role. While Target and other retail peers face margin pressure and weakening consumer demand, Walmart has capitalized on high-income customer migration and strong omnichannel growth. Its Nasdaq move is widely seen as a way to highlight this transformation and align the company with the market’s dominant tech-driven narrative.

E-Commerce up 28%, AI-Generated Code at 40%: Data Showing Walmart’s Shift Into a Tech-Powered Retailer

Recent performance data shows how rapidly Walmart’s business model is changing.

- Revenue: +5.8% YoY

- Operating income: +33% YoY

- U.S. same-store sales: +4.5%

- E-commerce: +27–28% growth globally

E-commerce demand, curbside pickup, and same-day delivery have reshaped Walmart’s customer engagement model. Beyond revenue, the company is embedding technology deeply into operations.

Walmart says more than 40% of new software code is now created with generative AI assistance. Robotics-powered fulfillment centers are also expanding, increasing automation across logistics, replenishment, and last-mile delivery.

To understand this shift, comparing Walmart’s old profile with its emerging identity is helpful:

|

Category |

Traditional Value Retailer |

Tech-Enabled Hybrid Retailer |

|---|---|---|

|

Core sales model |

In-store, low-price focus |

E-commerce, pickup, delivery |

|

Competitive edge |

Scale, pricing power |

AI, automation, data analytics |

|

Investment focus |

Stores, inventory |

Robotics, digital operations |

|

Market image |

Defensive consumer staple |

Tech-powered retail platform |

|

Key risks |

Consumer slowdown |

Tech investment cost, margin pressure |

These structural changes support the idea that the Nasdaq move is more than symbolic. It reflects the company’s position as a retail technology operator rather than just a brick-and-mortar giant.

What Analysts See: Investor Base Shifts, Valuation Rethinking, and Exchange-Level Competition

Analysts point to three major implications of Walmart’s Nasdaq transition.

1. A broader investor base

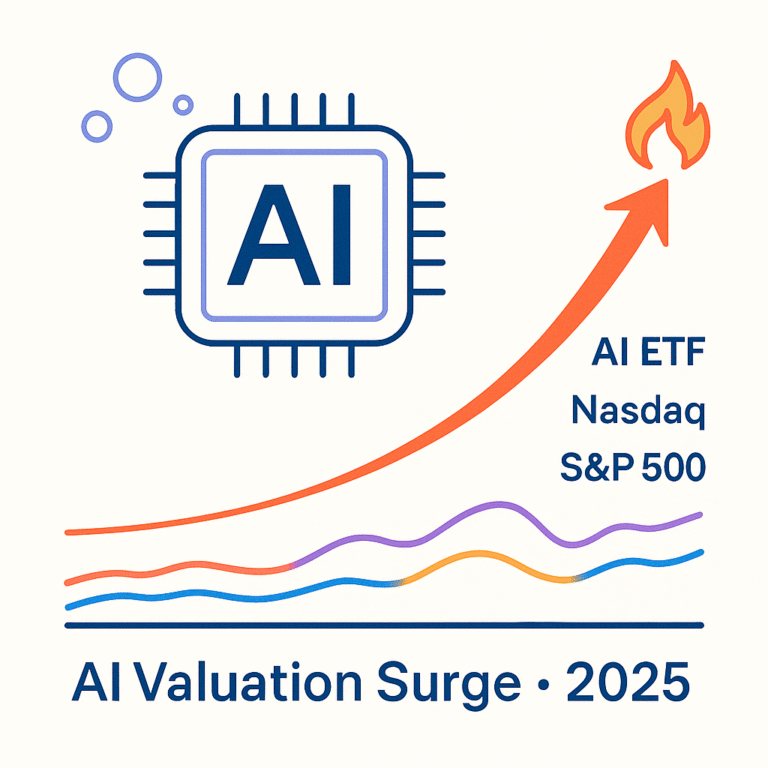

Nasdaq attracts growth-focused, tech-oriented investors. Walmart’s listing move increases visibility among portfolios that previously centered on software, semiconductors, and digital transformation themes.

2. A shift in valuation framework

Historically valued as a defensive consumer staple, Walmart is now being viewed as a value-plus-growth hybrid. If e-commerce and automation continue to scale, the market may gradually apply a mild growth premium to its valuation.

3. Nasdaq’s symbolic win over the NYSE

Walmart is one of the NYSE’s largest companies. Its departure is seen as a strategic victory for Nasdaq, which has been expanding its appeal beyond pure technology names into AI-enhanced retail and supply chain firms.

These factors show how the listing move may reshape Walmart’s long-term market perception.

Nasdaq-100 Inclusion and Potential ETF Inflows: How Index Funds Could Reshape WMT Demand

Walmart’s move to Nasdaq opens important index-related possibilities:

1. Potential inclusion in the Nasdaq-100 (NDX)

Walmart already meets the size and liquidity requirements. If added, QQQ and QQQM—along with dozens of derivative indices—would automatically purchase WMT, strengthening demand mechanically.

2. Increased relevance to tech and quality ETFs

As Walmart scales AI-powered logistics and digital revenue streams, it could fit selection criteria for certain growth, quality, or digital transformation ETFs.

3. A changing role inside consumer staples ETFs

Even within XLP and other sector funds, Walmart’s identity is shifting. It is no longer just a defensive retailer—it is becoming a diversified retail platform with measurable tech exposure.

For investors, these index-related shifts could influence short-term flows and long-term positioning.

Four Investor Checkpoints: How to Evaluate Walmart as a Value-Plus-Growth Hybrid

1. Sustainability of e-commerce and profit growth

Walmart’s long-term narrative depends on whether it can maintain high-single-digit digital revenue growth.

2. Efficiency and cost trajectory of AI and automation

Automation boosts efficiency but requires multi-year investment. Monitoring margins is essential.

3. Consumer-cycle sensitivity

Walmart has offset lower-income softness with high-income customer gains, but deeper macro slowdowns could affect all customer tiers.

4. Portfolio role clarity

Walmart can serve as both a defensive anchor and a moderate growth engine. Investors need to decide where WMT fits:

- Dividend-stable anchor?

- Tech-enabled retail growth play?

- Or a hybrid alternative to volatile mega-cap tech?

These checkpoints help frame whether Walmart deserves increased allocation in a diversified portfolio.

Walmart’s move from the NYSE to Nasdaq marks a pivotal moment in its evolution. The company is aggressively integrating AI, automation, and data-driven retail systems—reshaping its identity from a traditional consumer staple to a tech-powered retail platform.

For investors, the next 12–24 months will be important. E-commerce scaling, automation returns, and potential Nasdaq-100 inclusion could all influence the stock’s long-term trajectory.

If you’re building a portfolio that blends stability with measured growth, Walmart’s transformation offers a compelling case to watch closely.

References

- Reuters – Walmart bumps up outlook ahead of holidays, plans listing switch to Nasdaq

- Reuters – Walmart moves to Nasdaq, marking biggest-ever exchange transfer

- Financial Times – Walmart to shift listing to Nasdaq as retailer raises sales forecasts

- Investopedia – Walmart Is Talking Up Its Tech Focus. A New Stock Exchange Is Its Next Move

- AP News – Walmart raises profit expectations as more Americans hunt deals in sluggish economy

- Reuters – Walmart bets on AI super agents to boost e-commerce growth

- Investopedia – Symbotic Stock Pops on New Robotics Partnership With Walmart

- GuruFocus – Walmart to Transfer Stock Exchange Listing to Nasdaq