Why Alphabet’s $75B AI Investment Strategy is Paying Off in 2025

Discover how Alphabet’s $75 billion AI investment is driving 14% revenue growth and transforming Google Cloud into a dominant force in 2025.

Key Takeaways

When Alphabet CEO Sundar Pichai announced the company’s plan to invest approximately $75 billion in capital expenditures for 2025, investors worldwide took notice. This represents an aggressive push into AI territory, but it’s also translating into substantial revenue gains. With Alphabet’s 2024 full-year revenue climbing 14% from $307 billion in 2023 to reach $350 billion, the $75 billion investment proves to be more than just spending—it’s a strategic revenue-generating engine.

AI Investment Landscape: The $75 Billion Backdrop

2024 Performance and 2025 Plans

According to Reuters reports, the company is estimated to have spent $50 billion on AI in 2024 and is expected to spend more in 2025. This represents a 50% increase from $50 billion in 2024 to $75 billion in 2025, signaling a strategic move to secure market dominance in the AI sector.

This massive investment is primarily focused on AI infrastructure development, data center expansion, and machine learning model advancement. As demonstrated by Alphabet’s reported revenue of $88.3 billion with profits shooting up by 35% in Google Cloud thanks to growth in the company’s AI infrastructure, the return on investment remains remarkably high.

Investor Concerns and Expectations

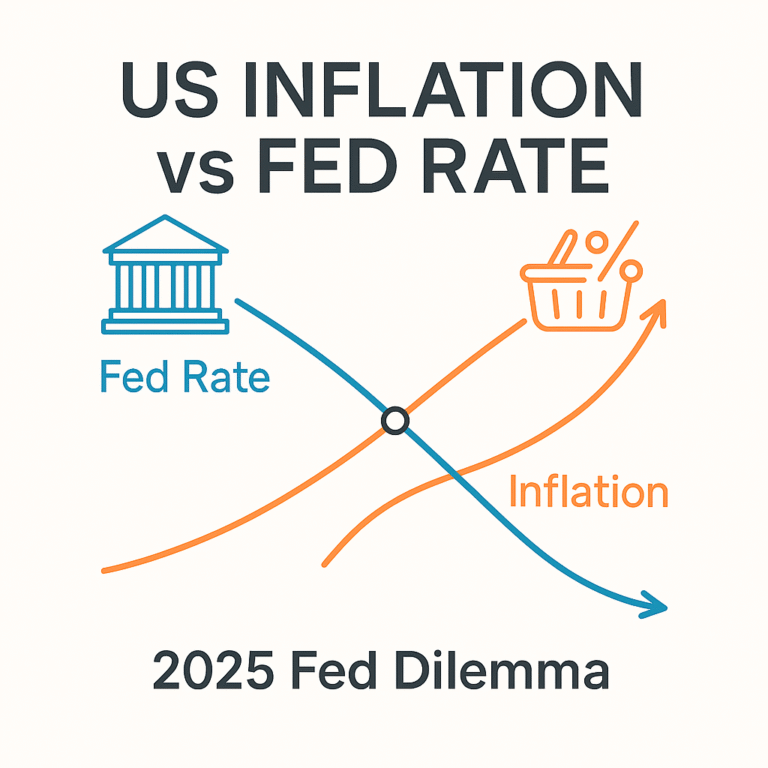

While Alphabet shares dropped as much as 9% on revenue miss and soaring AI investments, analysts view this as a short-term market reaction. Investors express concerns about massive AI spending while maintaining positive long-term profitability outlooks.

Core Revenue Drivers: AI-Generated Performance

Google Cloud’s Remarkable Growth Trajectory

Google Cloud revenue surged by 35% with the help of AI, marking the fastest growth rate in eight quarters. This performance directly demonstrates the tangible results of AI investment. The surge in demand for AI solutions in cloud services plays a pivotal role in Alphabet’s overall revenue growth.

According to Q3 2024 performance analysis, Google Cloud revenue climbed 35% due to high demand for AI solutions. As enterprise AI adoption accelerates, Google Cloud’s AI infrastructure services are gaining particular traction among businesses.

AI Enhancement Effects on Search and YouTube

Google’s core businesses—search services and YouTube—are experiencing significant revenue increases through AI technology integration. Google Services revenues increased 10% to $84.1 billion, reflecting strong momentum across Google Search & other and YouTube ads.

AI-powered search algorithm improvements and personalized advertising targeting technologies are attracting advertisers’ attention, leading to continuous advertising revenue growth.

Data and Chart Analysis: Performance by Numbers

Revenue Growth Rate Analysis

These figures clearly demonstrate that AI investment serves as a core revenue generation driver rather than merely an expense.

Operational Efficiency Improvements

According to reports stating that a quarter of Google code is now generated using AI, 25% of Google’s code is already AI-generated, significantly improving development efficiency. This enables both operational cost reduction and faster product development simultaneously.

Expert Opinions and Market Analysis

Industry Expert Evaluations

Major economic publications including Forbes and WSJ positively evaluate Alphabet’s AI investment strategy. They particularly analyze that AI applications in cloud services and search advertising play crucial roles in securing competitive advantages.

Bloomberg’s technology analysts forecast that while Alphabet’s AI investment may cause short-term stock volatility, it will contribute to long-term market dominance strengthening and profitability improvements.

Competitive Advantages Over Rivals

Compared to competitors like Microsoft and Amazon, Alphabet possesses unique data assets including search data and YouTube content, providing differentiated competitive advantages in AI model training.

Market Impact and Implications

Advertising Market Transformation

As AI-based advertising targeting and personalization technologies advance, the entire digital advertising market is transforming. Alphabet’s AI technology improves advertising efficiency, enhancing advertisers’ ROI and attracting more advertising budgets to Google platforms.

Cloud Services Market Reshaping

The achievement of Google Cloud revenue surging by 35% with AI help significantly strengthens Google’s position in the cloud market. As enterprise AI adoption accelerates, demand for Google Cloud’s AI services is experiencing explosive growth.

Impact on Technology Talent Market

Intense competition for AI technology talent acquisition is driving wage increases and active talent mobility in the technology workforce market. Alphabet’s massive AI investment further accelerates these market changes.

2025 and Beyond

Strategic Investment Allocation and Expected Returns

Alphabet’s $75 billion investment plan for 2025 focuses on AI data center expansion and machine learning model development. The company is strategically allocating resources toward computational infrastructure that supports growing Google Cloud demand while enabling sophisticated AI optimization processes.

The investment strategy encompasses AI chip development and infrastructure construction, positioning Alphabet to reduce external supplier dependency while improving cost efficiency. The company plans to accelerate new AI service launches targeting both consumer and enterprise markets with solutions leveraging their vast data ecosystem.

Navigating Market Challenges and Capitalizing on Opportunities

The AI investment landscape presents both substantial risks and unprecedented opportunities for Alphabet. Regulatory authorities worldwide focus increasingly on AI governance, with potential policy changes affecting operational flexibility. Competition intensifies as tech giants invest heavily in similar technologies.

However, Alphabet’s unique position as owner of the world’s most popular search engine and YouTube provides distinctive advantages in data collection and model training. The enterprise AI solution market presents significant growth opportunity, with businesses seeking to integrate AI capabilities into operations.

Market Predictions and Performance Targets

Industry analysts maintain optimistic projections for Alphabet’s AI investment returns, anticipating Google Cloud revenue will surpass $50 billion by 2025. This reflects increasing enterprise adoption of AI infrastructure services and the company’s strengthening market position.

AI-related revenue streams are expected to comprise over 30% of Alphabet’s total revenue within two years, representing fundamental transformation of revenue composition. Operational efficiency improvements exceeding 20% are projected as AI integration deepens across business units, building on current gains where 25% of Google code is AI-generated.

The Success Formula for AI Investment

Alphabet’s case represents a quintessential success story demonstrating how AI investment can translate into substantial revenue increases. Despite the massive $75 billion investment scale, the company achieved clear results with Google Cloud’s 35% growth and overall revenue increase of 14%.

Despite short-term stock volatility, Alphabet’s AI investment strategy appears to be the right direction for securing sustainable long-term growth drivers. The synergy effects from AI applications in cloud services and advertising platforms provide differentiated competitive advantages that other companies cannot easily replicate.