Why the 2025 U.S. 10-Month Layoff Surge & AI Data-Center Investment Boom Could Rock the Stock Market

Discover how the U.S. 10-month layoff surge and the AI/data-center investment boom are creating structural risks for growth stocks—and how investors should respond.

Key Takeaways

✔ In October 2025, U.S. employers announced about 153,074 job cuts, a 175% rise year-on-year—the worst October since 2003.

✔ Major tech firms’ capital expenditures for AI/data-centers are estimated at around USD $370 billion in 2025, signalling a sweeping infrastructure shift.

✔ Simultaneous labour-market stress and infrastructure overinvestment may mark a turning point for growth-stock dominance.

✔ AI/data-center investment growth brings hidden risks: heavy power demand, high leverage, and delayed return on capital.

✔ Investors should monitor four key areas: employment & hiring data, AI investment-to-revenue conversion, interest rate trajectory, and infrastructure cost pressures.

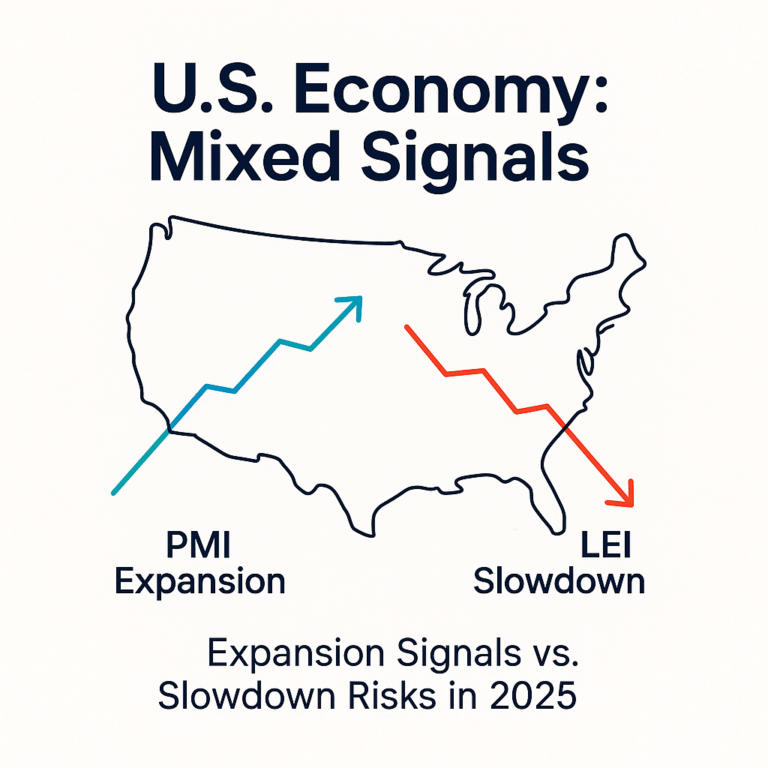

Two Signals, One Alarming Intersection

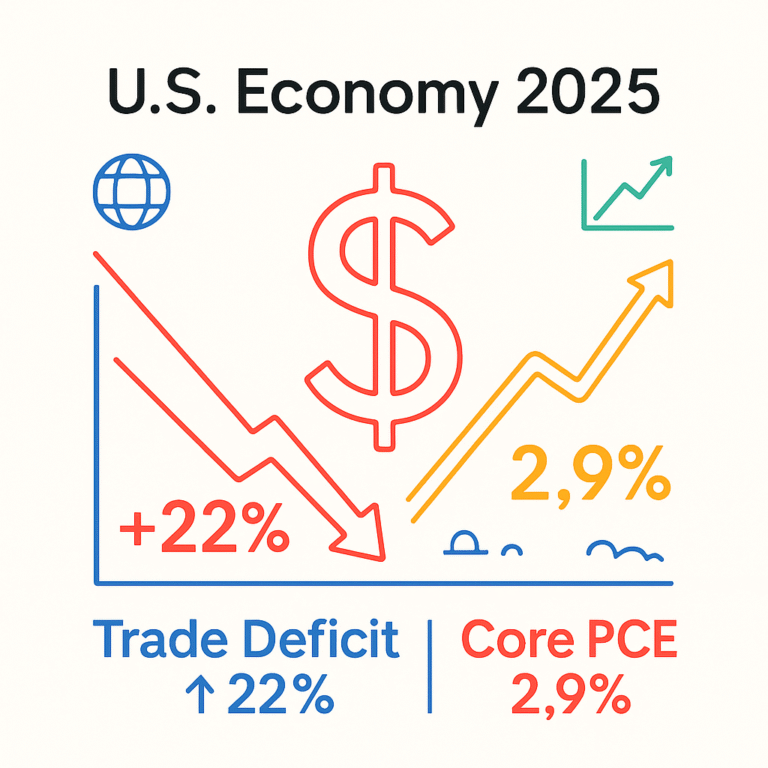

In October 2025, U.S. firms announced approximately 153,074 job cuts, registering the worst October in at least two decades. Over the first ten months of the year, total announced layoffs topped 1.09 million, up about 65% year-on-year. Simultaneously, the rapid rise of AI infrastructure investment—with mega-cap tech firms pouring tens of billions into data-centers—has shifted a huge portion of private demand into capital-intensive spending.

This unusual conjunction—job-market deterioration paired with massive AI/data-center capital outlay—suggests we may be at a structural inflection point for the U.S. equity market. In the sections below, we trace the timelines, examine the data, incorporate expert commentary, explore implications, and describe what investors should watch for next.

The Layoff Surge – What 153,074 Cuts Reveal about Labour and Growth

The reported figure of roughly 153,074 announced job cuts in October 2025 is dramatic—about a 175% increase from the same month in 2024. While cost-cutting remains the most cited reason, firms are increasingly pointing to AI-driven automation and restructuring as catalysts.

Key observations

- The tech sector is at the forefront of these cuts, shifting from hiring growth to job reductions.

- Logistics and retail also show acute stress—bearish signs for consumer spending.

- The magnitude and breadth of cuts go beyond typical cyclical resets and may reflect labour-market structural change.

The consequence: weaker consumption, lower hiring momentum, and a feedback loop into corporate earnings and investment. Put differently, what once was a “hire slowly, fire rarely” environment is showing cracks. Investors should note: this isn’t just a pause—it may signal shift.

AI/Data-Center Investment Boom – The Infrastructure Play’s Hidden Risks

Mega-cap firms such as Microsoft, Alphabet, Meta and Amazon are projecting combined capital expenditures in AI/data-center infrastructure at around USD $370 billion in 2025.

This surge is reshaping how demand is generated. Instead of consumer or business-services growth, a large share of private investment is being funneled into machines, servers, power, facilities.

Yet the challenges are real

- Power and cooling: Data-centers already account for ~4% of U.S. electricity use; growth projections point to steep increases.

- Return on capital: The ROI timeline for these investments remains uncertain—by one estimate, data-center investment may add only 10-20 basis points to U.S. GDP in 2025-26.

- Leverage and costs: Heavy cap-ex, long lead-times and high debt burdens may expose companies if growth slows.

In short, the infrastructure rush may be sowing the seeds of an “AI/data-center bubble” rather than a sustainable growth engine. The risk is that expectations outrun execution.

Market Response & Valuation Stress – Growth Stocks Under Pressure

Markets are reacting. Major U.S. indices fell recently amid concerns about job losses and stretched valuations. For example, the Nasdaq Composite dropped ~1.9% and the S&P 500 fell ~1.1% on a single trading day.

Below is a summary of key data points:

|

Metric |

Recent Value/Trend |

Implication for Markets |

|---|---|---|

|

October layoff announcements |

~153,074 jobs (~+175% YoY) |

Labour-market stress → consumption/investment softening |

|

Tech sector job cuts |

Elevated compared to prior months |

Growth sector exposed to structural headwinds |

|

AI/data-center investment |

~$370 billion projected in 2025 |

Heavy cap-ex may burden earnings if turnaround delayed |

|

Data-center energy demand |

~4% of U.S. electricity use and rising |

Higher operational cost, infrastructure risk |

These converging signals prompt a re-evaluation of growth-stock dominance. Investors who assumed unlimited expansion benefits for AI/tech may now face a more nuanced reality: high expectations + increasing risks = potential for re-rating.

Structural Implications – Economy, Finance & Policy

Real Economy

When job cuts rise and hiring stalls, consumption tends to follow. Given the U.S. economy’s heavy reliance on consumer spending, this is a major concern. Overlaid on that is the shift of capital toward AI infrastructure rather than traditional business growth—raising questions about long-term productivity gains.

Financial & Valuation Dynamics

Capital-intensive AI/data-center firms carry higher fixed costs, heavy debt and longer payback periods. In a higher-rate environment, their risk profile increases. The layoff surge signals broader cost pressures, which may chip away at margins and investor optimism.

Policy & Infrastructure

The U.S. is also facing a data-gap problem: the federal government shutdown has delayed official employment and inflation data. That leaves policymakers and markets navigating by partial signals.

At the same time, infrastructure and energy needs tied to AI/data-centers are placing new demands on regulation, power markets and financing frameworks.

The bottom line: What may look like growth at first glance is layered with risk and complexity.

What’s Next – Key Watchpoints and Risk Scenarios

Watchpoints:

- Employment & hiring data: If layoffs continue or hiring stalls, confidence will erode further.

- AI/data-center monetization: Are these investments translating into revenue growth and margin expansion?

- Interest rates & inflation: A return to higher rates would pressure growth-stock valuations and cap-intensive firms.

- Infrastructure stress: Power grid bottlenecks, higher energy costs or financing issues could trigger operational shocks.

Risk Scenarios:

- Base case: Labour market stabilises, AI infra rolls out gradually, growth returns—but valuation multiples shrink.

- Downside case: Layoffs deepen, AI/data-center investments deliver weak returns, rates stay high → growth stocks suffer.

- Upside case: AI infra leads to productivity surge, earnings rebound, growth resumes—but only select companies benefit.

Investors should consider adjusting portfolios not just to growth or value, but to the quality of growth, the strength of cash flow and the resilience of business models.

Investor Strategy – Navigating Growth in a New Environment

Risk-mitigation approach:

- Reduce concentration in hyper-growth/AI-pure plays; increase exposure to companies with stable cash flows and lower leverage.

- Seek parts of the chain where AI/data-center investment is less speculative—such as power infrastructure, cooling systems, and supply-chain enablers.

- Maintain liquidity/hedge capacity, since we may be in a phase where news headlines (layoffs, AI announcements) drive outsized market moves.

Selective-opportunity approach:

- If you believe AI/data-center growth is real, identify firms with strong margins, manageable debt and clear monetisation of infrastructure.

- Use macro-data release events (employment, hiring, CPI, power usage) as potential entry or exit signals rather than “buy the dip” blindly.

The key mindset: It’s no longer just about growth. It’s about growth delivered reliably in the face of structural change.

October 2025’s surge in U.S. job cuts and the explosive growth of AI/data-center investment together may mark a structural inflection point for the stock market. Growth-stock dominance, once viewed as a given, now faces new tests: labour-market weakness, infrastructure overhang, high valuations and policy uncertainty.

For investors, the moment calls for a reality check: growth opportunities remain, but the path to returns may be narrower and less certain. It’s time to reassess strategies, prioritise sustainable business models, and adjust for the risk that the “next the next” growth cycle may look very different from the last.

References

- Reuters — “U.S. layoffs surge to two-decade high in October 2025”

- Challenger, Gray & Christmas — “October Report: 153,074 Job Cuts Driven by AI and Cost Reduction”

- Wired — “The AI Data-Center Boom Is Warping the U.S. Economy”

- S&P Global Research — “Data-Center Investments Are Moving the Macro Needle”

- The Economist — “The Murky Economics of the Data-Center Investment Boom”

- Pew Research Center — “Data Centers Now Use 4% of U.S. Electricity—and Rising”

- Bloomberg — “AI Capex and Labor Cuts: Why Wall Street Is Turning Cautious on Tech Valuations”

- Business Insider — “Layoffs hit a two-decade high as AI disruption reshapes jobs”

- Fortune — “Data-Center Spending Adds to GDP but May Delay Productivity Gains”

- Reuters — “Debt Risks Emerge in AI Infrastructure Financing”